Compare Insurance Quotes Kimboleeey — Compare Auto Insurance

When it comes to purchasing insurance, finding the best rate often requires comparing multiple quotes. This process can be challenging because of the various options available, but it is essential for ensuring that you receive the best coverage at the most affordable price. Whether you’re looking for auto insurance, travel insurance, or any other form of coverage, comparing insurance quotes can save you money and provide you with the peace of mind you deserve.

Understanding how to effectively compare insurance quotes involves several crucial steps:

- Identify Your Coverage Needs: Before you begin requesting quotes, clearly outline what type of coverage you need. Are you looking for basic liability insurance, or do you want comprehensive coverage that includes theft and collision? Knowing what you need will help you accurately compare quotes.

- Research Different Providers: Not every insurance provider offers the same policies or coverage options. Take your time to research different insurance companies. Look into their reputation, customer service ratings, and financial stability to ensure you’re choosing a reliable provider.

- Gather Quotes: Reach out to multiple insurers and request quotes specific to your needs. Most providers allow you to get quotes online, which can streamline the process. Make sure you provide the same information to each company to ensure accuracy in comparison.

- Compare Coverage Options: Once you have gathered your quotes, compare the details. Look beyond the price; consider the extent of coverage included in each policy. Some may have lower premiums but lack essential coverage options.

- Examine Deductibles and Limits: When comparing quotes, take note of the deductibles for each policy. A lower premium may come with a higher deductible, meaning you’ll need to pay more out of pocket in the event of a claim. Balance your premiums with the deductibles and limits to determine which option best fits your budget.

- Look for Discounts: Many insurers offer discounts for various reasons—safe driving records, bundling multiple policies, or being a member of certain organizations. Ensure you inquire about any discounts that could lower your premium.

- Read Reviews and Ratings: Customer experiences can reveal a lot about an insurer. Look for reviews or ratings from other policyholders regarding claims processing, customer service, and overall satisfaction. This can help you gauge whether the insurer will meet your expectations.

- Consult an Agent or Broker: If you find the process overwhelming, consider consulting with an insurance agent or broker. They can provide expert advice and help you navigate through the various options available to find the best policy for your needs.

After you have gone through these steps, you will be better equipped to make a well-informed decision about your insurance policy. Remember that comparing insurance quotes is not just about finding the lowest price; it’s also about understanding what you are getting for that price.

Auto Insurance Quotes Comparison - Security Guards Companies

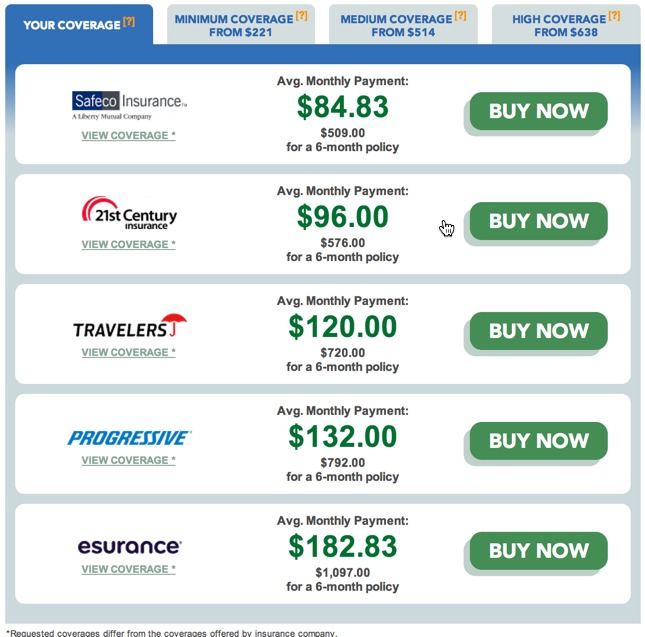

The insurance market is vast, and understanding how to navigate it can be tricky. Platforms that offer comparisons of car insurance quotes can simplify your search by presenting multiple options in one place, making it easier to find an ideal policy with favorable terms and conditions. Such tools can highlight a variety of plans side-by-side, illustrating the differences in coverage, exclusions, premiums, and deductibles.

One Stop Car Insurance Shopping - Family Fun Journal

Platforms advocating for one-stop shopping for car insurance provide invaluable resources. They allow consumers to input their specific criteria and display a selection of options that meet those needs. Many of these platforms also come with tools and calculators to help you understand your potential costs, potential savings from different providers, and the benefits of certain policies to assist in your decision-making process.

How to Compare and Buy Travel Insurance Online

When it comes to travel insurance, understanding the nuances of different policies is critical. Comparing travel insurance requires careful consideration of factors like medical coverage, trip cancellation insurance, and coverage for personal belongings. Online platforms dedicated to travel insurance comparisons help travelers make informed choices, balancing their needs against potential risks and expenses.

Compare Texas Car Insurance Rates & Save Today | Compare.com

In specific regions like Texas, different insurance rates may apply based on numerous factors including regional risk assessments. Using resources that provide localized comparisons can yield better financial outcomes, especially in areas with varying accident rates, claims frequency, and legislative differences impacting premiums.

How to Compare Travel Insurance Companies (Updated June 2022)

Travel insurance is essential for mitigating risks associated with travel. An effective comparison strategy includes looking at aggregate data from various travelers, features like emergency medical assistance, and specific conditions that various insurers cover. Dive deep into the fine print to understand exact coverage limits and exclusions which could affect claims.

Online Car Insurance Comparison Quotes - SERMUHAN

Digital platforms for online car insurance comparisons have revolutionized how consumers approach policy shopping. They save time and provide comprehensive data at your fingertips, enabling you to compare various aspects such as customer service ratings, policy features, and pricing in an efficient manner.

Questions to Consider

1. What factors should I consider when comparing insurance quotes?

When comparing insurance quotes, consider coverage options, premiums, deductibles, policy limits, exclusions, and available discounts. Each aspect can significantly impact your overall experience and financial outcome.

2. How can I ensure I am getting an accurate comparison of insurance quotes?

To ensure an accurate comparison, provide the same personal and vehicle information to each insurer, and request quotes for identical coverage levels. This consistency allows for fair evaluations of the rates and policies offered.

3. Why is it vital to read customer reviews before selecting an insurance provider?

Reading customer reviews is essential because it provides insights into the company’s reliability, service quality, and claims handling process. A provider with positive reviews is likely to offer a better overall experience, including prompt claims processing and customer support.