Insurance Company Top 10 Life Insurance Companies In Malaysia

Insurance companies play a critical role in the financial stability of individuals, businesses, and society at large. These organizations provide risk management solutions that help mitigate potential losses and provide peace of mind. As a multifaceted industry, insurance encompasses various sectors including health, auto, home, and life insurance, each designed to cover specific risks associated with everyday life and business activities. Below, we will explore the key components of insurance companies, their importance, and how they operate.

Key components of insurance companies:

- Types of Insurance: Insurance companies offer a variety of policies to cater to different needs:

- Health Insurance: Covers medical expenses for illnesses, injuries, and other health-related issues.

- Auto Insurance: Provides financial protection against physical damage and/or bodily injury resulting from traffic collisions, as well as liability that could also arise from incidents in a vehicle.

- Home Insurance: Protects against damages to the home and possessions within it, as well as liability for accidents that occur in the home.

- Life Insurance: Offers financial support to beneficiaries in case the insured individual passes away, ensuring loved ones are taken care of financially.

- Premiums: The fee paid by policyholders for coverage, which is calculated based on the risk associated with insuring an individual or entity.

- Claims: The request made by the policyholder for payment or compensation for a loss covered by the insurance policy.

- Underwriting: The process used by insurance companies to evaluate the risk of insuring someone and determining the premium to charge.

Importance of Insurance Companies:

- Financial Security: Insurance companies provide a safety net that helps individuals and businesses manage risk, ensuring financial stability in the face of unexpected events.

- Promoting Peace of Mind: Knowing that there is financial support available in case of unforeseen circumstances allows individuals and businesses to focus on their everyday activities without fear of financial ruin.

- Encouraging Economic Growth: By reducing uncertainty, insurance fosters economic development and stability, enabling businesses to invest and expand without the constant fear of loss.

- Support for Social Welfare: Many insurance companies contribute to social programs, providing not just a safety net for policyholders, but also supporting community initiatives that improve quality of life.

This image depicts various logos of insurance companies, highlighting the diversity in service providers within the industry. It's important to understand the different players in the insurance market as they reflect the range of options available to consumers.

This image presents health insurance companies, emphasizing the importance of health coverage in today's world. Health insurance is a crucial component of personal finance, ensuring that individuals can afford healthcare services without incurring crippling debt.

The significance of having the right legal assistance when dealing with car accident claims is portrayed in this image. Auto insurance companies often face claims that require legal intervention, showcasing the complex relationship between policyholders, insurers, and the law.

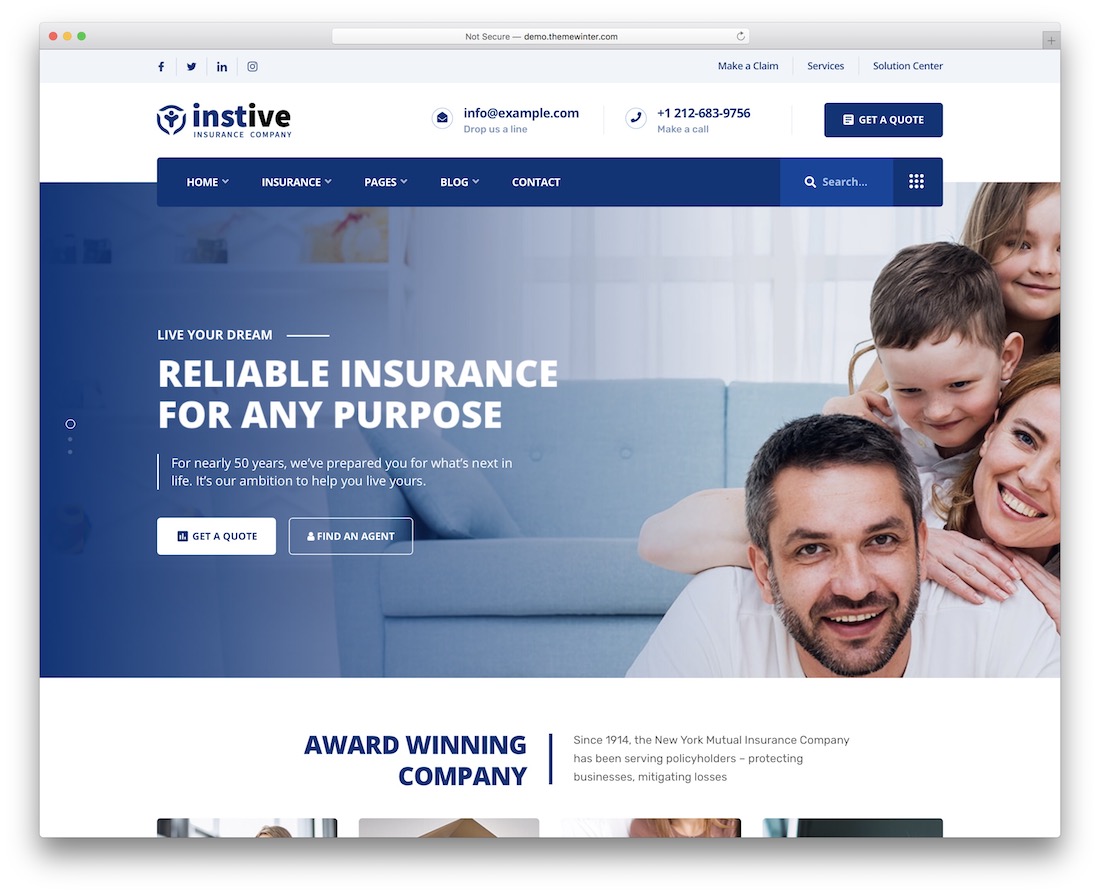

This image highlights the importance of digital marketing for insurance companies. As more consumers turn to the internet for information, insurance providers must ensure that they are visible online, catering to a tech-savvy client base.

This image represents the variability in homeowner's insurance, particularly focused on fire damage coverage. Different companies may excel in certain areas, making it essential for consumers to research their options thoroughly before making investments.

This compilation of insurance companies offers a glimpse into a specific market segment outside the US, showcasing the global nature of the insurance industry and the different regulations and offerings according to local markets.

1. What role do insurance companies play in personal and economic stability?

Insurance companies serve as crucial agents of risk management, helping individuals and businesses take control of their financial vulnerabilities. By providing coverage for potential losses, these companies foster economic stability, enabling everyday people and enterprises to operate without the fear of catastrophic financial outcomes. This reassurance enhances consumer confidence and encourages economic activity, as individuals are more likely to invest in homes, cars, health, and businesses when they know their risks are mitigated.

2. How do insurance policies ensure that policyholders receive adequate coverage?

Insurance policies are structured to provide comprehensive coverage through various terms and conditions tailored to specific needs. Insurers assess individual risks and calculate premiums accordingly, allowing policyholders to choose limits and options best suited to their circumstances. This customization ensures that policyholders are neither underinsured nor overinsured, striking a balance that adequately addresses potential losses without excessive costs.

3. What factors influence the cost of insurance premiums, and how can consumers manage these costs?

The cost of insurance premiums is influenced by multiple factors, including the level of risk associated with the policyholder, the type and amount of coverage required, claims history, and the insurer’s assessment of market conditions. Consumers can manage these costs by maintaining a good credit score, opting for higher deductibles, comparing quotes from different companies, and taking advantage of discounts for bundled policies or safe practices.