Auto Insurance Quotation Insurance Quote Sheet Form Producer Fillable Online Pdffiller Get

Auto insurance quotations are vital for anyone seeking to comprehend the costs associated with insuring a vehicle. Understanding the intricacies involved in obtaining an auto insurance quote can simplify the process and aid in choosing the right insurance provider. Auto insurance protects from financial losses resulting from accidents, theft, and natural disasters affecting a vehicle. The following elaborates on essential aspects of auto insurance quotations.

- Definition of Auto Insurance Quotation: An auto insurance quotation refers to an estimate provided by an insurance company detailing how much it would cost to insure a specific vehicle based on various factors, including the driver's profile, the car's make and model, and coverage options.

- Factors Influencing Auto Insurance Quotations:

- Driver's Age and Experience: Younger drivers or those with less experience may face higher premiums.

- Type of Vehicle: Sports cars or high-value vehicles often attract higher insurance costs due to their associated risks.

- Driving History: A clean driving record can lead to lower premium costs, while accidents or traffic violations may increase them.

- Coverage Options: The selected coverage type, such as liability, collision, or comprehensive, will significantly impact the quote.

- Geographic Location: Areas with higher crime rates or accident frequencies may result in higher premiums.

- Importance of Comparing Quotes:

- Comparing quotes from different insurers is crucial to ensuring that individuals receive the best coverage at the most competitive price.

- Online tools and resources are available that facilitate comparison shopping for auto insurance quotes from multiple providers.

- How to Obtain an Auto Insurance Quotation:

- Identify the coverage needed (e.g., liability, collision, comprehensive).

- Gather necessary documents, including your driver's license, vehicle registration, and previous insurance information.

- Utilize online insurance platforms or agents to request a quote, providing accurate information to receive an appropriate estimate.

- Understanding the Quote Breakdown:

- Most quotes will include a breakdown of the coverage options, premium costs, deductibles, and any discounts applied.

- It’s essential to read the quotation thoroughly to understand the coverage being purchased.

- Discounts and Savings Opportunities:

- Many insurers offer discounts based on factors like having multiple policies with them, vehicle safety features, or good driving history.

- Renewal and Re-Evaluation of Quotes:

- It's advisable to reassess insurance needs and obtain updated quotes periodically, especially before renewal periods.

- Changes in personal circumstances, such as moving to a new area or changes in driving habits, may prompt a need for a revised quote.

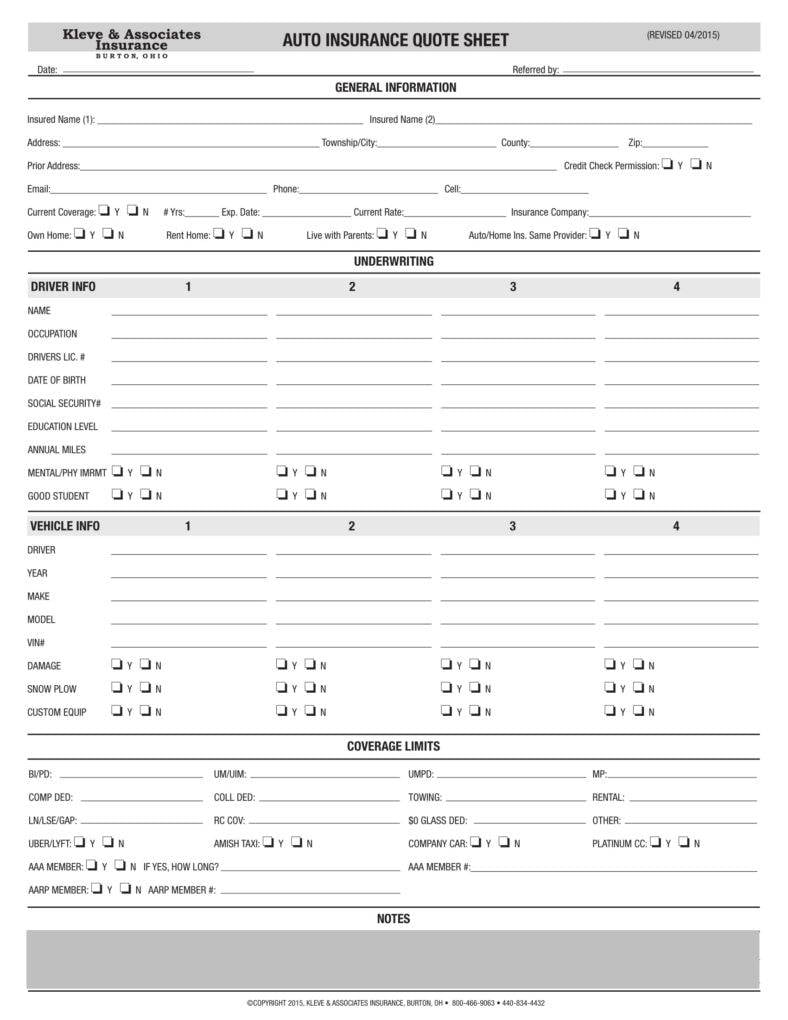

Auto Insurance Quote Image

This image represents an illustration of an auto insurance quote, highlighting what such quotes generally contain in written format.

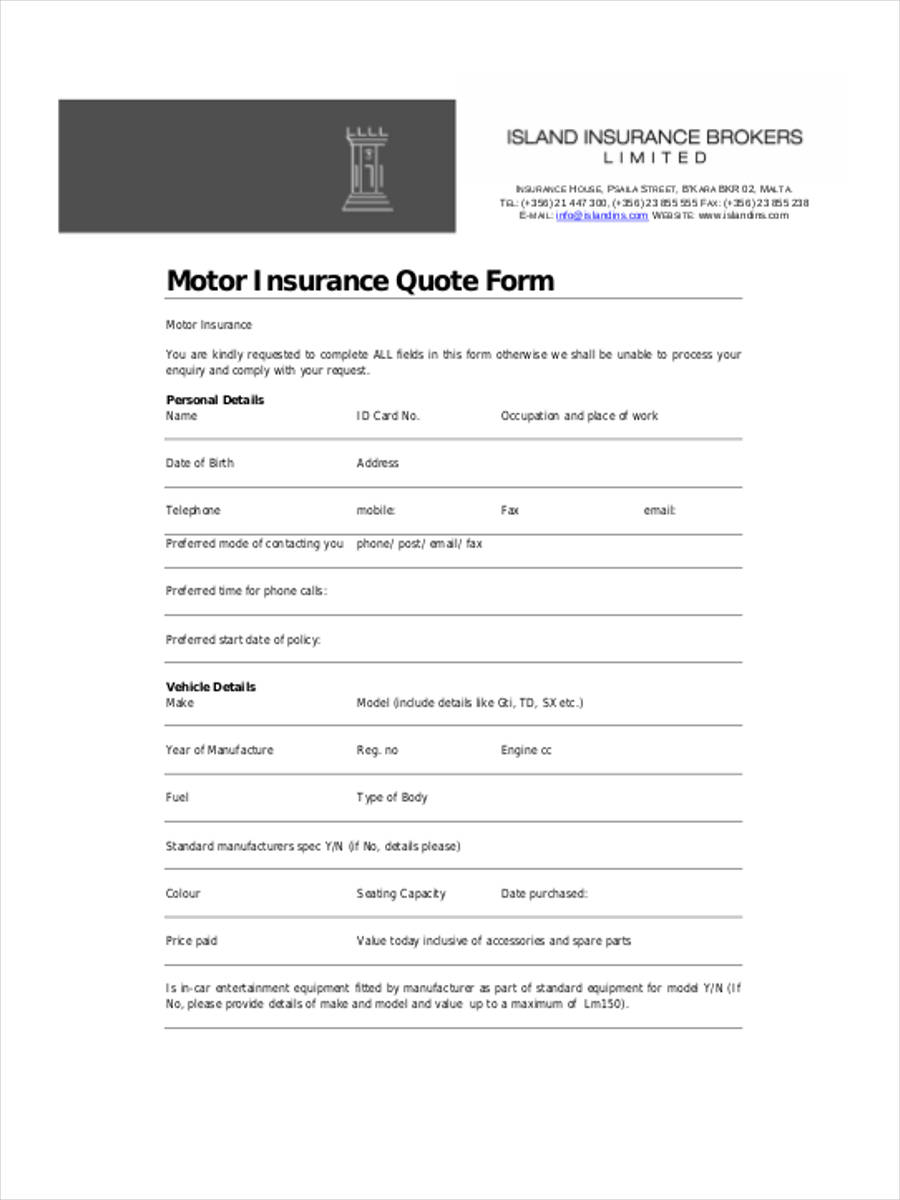

Second Auto Insurance Quote Image

This image depicts a sample motor insurance quote, further elucidating the format used by various insurance companies.

Understanding the Quotations Further

The concept of auto insurance quotations extends far beyond just numbers and estimates. It is about understanding the potential risks associated with driving and how insurance mitigates those risks. Having a detailed understanding of the quote is crucial for making informed decisions regarding car ownership and liability. Therefore, seeking multiple quotes and carefully analyzing them is encouraged.

Question 1: What is the main purpose of obtaining an auto insurance quotation?

Obtaining an auto insurance quotation serves the primary purpose of estimating the cost of insuring a vehicle. Policyholders utilize these quotations to compare coverage options, premiums, and determine which insurance policy aligns best with their financial and coverage needs.

Question 2: How can one effectively compare different auto insurance quotes?

Effectively comparing different auto insurance quotes involves reviewing each quote for coverage limits, premium costs, deductibles, and applicable discounts. Consumers should create a comparison chart to see differences side by side, and consider the reputation and customer service of the insurance provider when making a decision.

Question 3: What common factors are typically included in an auto insurance quote?

Common factors typically included in an auto insurance quote are coverage types, premium amounts, deductibles, the insured vehicle's value, driver history details, and any available discounts based on safe driving practices or bundled policies.