Auto Insurance Quote Insurance For New Car Quote

Auto insurance quotes are an essential element of the car insurance purchasing process and play a pivotal role in helping consumers make informed decisions. Understanding auto insurance quotes can often feel overwhelming, but this article aims to break it down into manageable parts. It will cover the various aspects of auto insurance, what a quote typically includes, how to obtain one, and tips for comparing quotes from different providers.

When considering auto insurance, it is crucial to recognize that a quote represents an estimate of the premium you will pay for your car insurance coverage. The quote is based on several factors, which can include but are not limited to:

- Driver's Personal Information: Age, gender, marital status, and location can significantly affect insurance rates.

- Vehicle Details: The make, model, year, and safety features of your vehicle will influence the cost of your insurance.

- Driving History: A record of accidents, traffic violations, or claims can lead to higher premiums.

- Coverage Types: The level of coverage you choose, such as liability, comprehensive, and collision, will impact your premium.

- Deductibles: Higher deductibles can lower your monthly premium but increase your out-of-pocket costs in the event of a claim.

Understanding the Components of an Auto Insurance Quote

Auto insurance quotes typically contain several key components detailing the policy terms and expected costs. This information is vital for consumers comparing insurance options:

- Premium Amount: The estimated monthly or annual cost of coverage.

- Coverage Limits: The maximum amount the insurance company will pay for a particular claim or set of claims.

- Expenses Included: Information about whether certain expenses, like towing or rental, are included in the policy.

- Discounts: Potential discounts for safe driving, multi-policy holders, or vehicle safety features.

How to Obtain Auto Insurance Quotes

Getting auto insurance quotes is simpler than many believe. Here are the steps to follow:

- Research Insurance Providers: Look for reputable insurance companies that offer auto insurance.

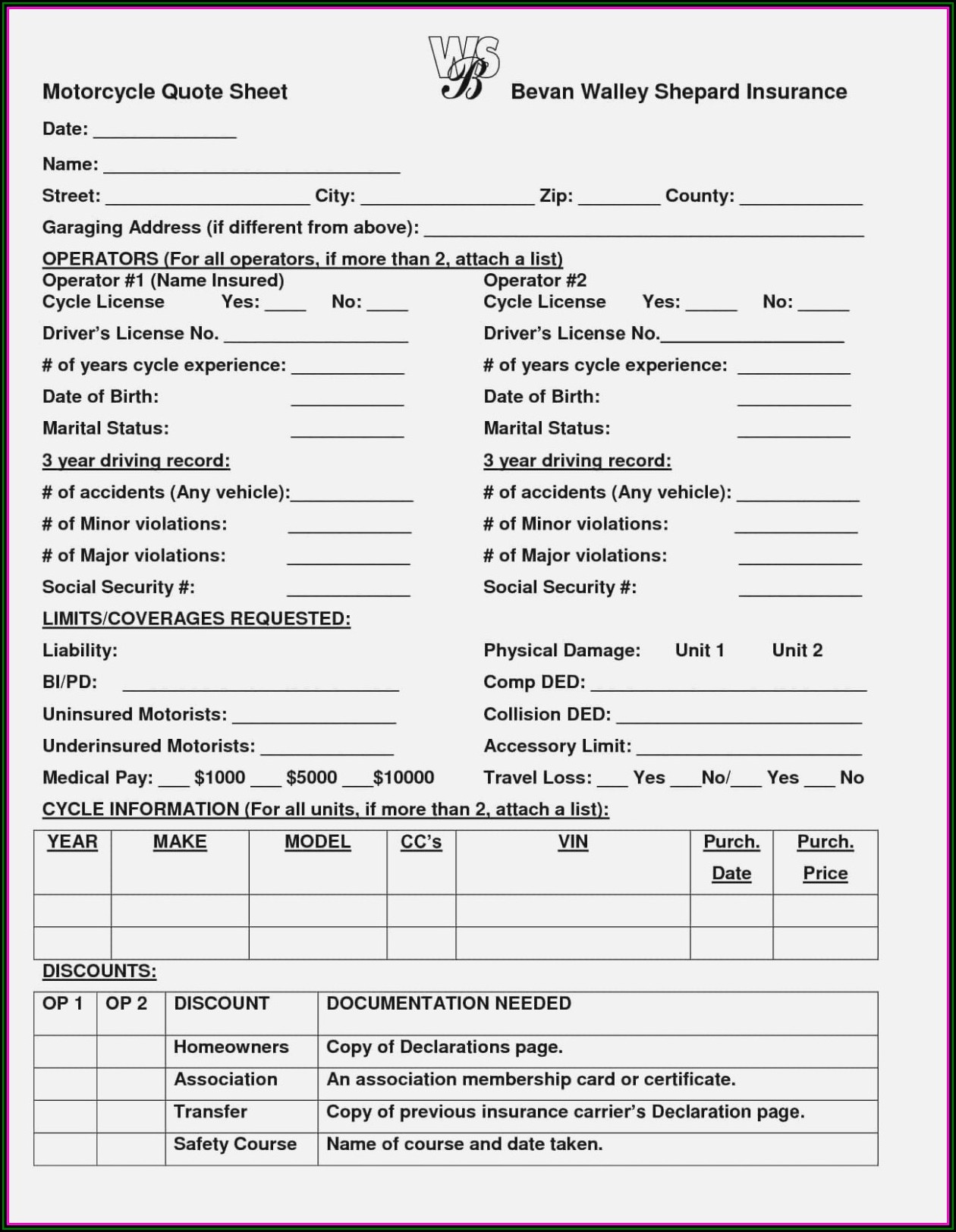

- Provide Necessary Information: Be prepared to share personal details, driving history, and vehicle information. This information is vital for an accurate quote.

- Request Quotes: You can get quotes through various channels, including online, over the phone, or through an insurance agent.

- Compare Quotes: After collecting several quotes, compare the coverage options, limits, and total costs.

Comparing Auto Insurance Quotes

Comparison shopping is crucial because different insurers offer varying rates for the same coverage. Here are some tips for effective comparison:

- Look at Similar Coverage: Ensure that you are comparing quotes for the same coverage limits and deductibles.

- Check Insurer Ratings: Review customer service ratings and claim settlement ratios to gauge reliability.

- Read Reviews: Customer reviews can provide insights into the experiences of other insurance policyholders.

- Inquire About Discounts: Ask about available discounts and whether they apply to your quote.

Final Considerations

After gathering and comparing quotes, it’s important to understand the coverage you are getting for the price. Ensure that you are choosing sufficient coverage to protect yourself financially in the event of an accident.

Additionally, consider revisiting your auto insurance quotes periodically, especially as your circumstances or those of the market change. Life events, such as moving to a new location, changing vehicles, or having a change in marital status, can all prompt a review of your coverage and rates.

Questions to Consider for a Better Understanding of Auto Insurance Quotes

1. How do various factors influence my auto insurance quotes?

Auto insurance quotes vary based on specific driver and vehicle-related factors. Personal attributes like age, gender, and location significantly impact the calculation of risk by insurers, thus affecting premiums. The vehicle's make and model, combined with its safety features, also play a role, as insurers consider the likelihood of theft or damage. Additionally, your driving history, which includes any traffic violations or accidents, directly influences your risk profile. Coverage levels and the choice of deductibles further refine the estimated premium. By carefully considering these elements, you can gain insights into how they shape your specific auto insurance quote.

2. Why is it beneficial to compare multiple auto insurance quotes?

Comparing multiple auto insurance quotes is essential for finding the most cost-effective coverage. Different insurance companies often have varying underwriting criteria, leading to significant price differences for the same coverage. By obtaining multiple quotes, consumers can evaluate the available options, ensuring they receive a comprehensive policy that meets their needs at a competitive rate. It's also a way to identify and take advantage of potential discounts that might not be offered by all insurers. Additionally, this practice helps consumers gauge the reliability and customer service performance of different providers, ultimately resulting in better policy decisions.

3. What is the importance of understanding policy details when reviewing auto insurance quotes?

Understanding policy details is crucial when reviewing auto insurance quotes because it ensures that consumers make informed decisions about their coverage. The specifics of a policy, such as coverage limits, deductibles, exclusions, and additional features, can greatly affect the policy's efficacy during a claim. An attractive quote may come with hidden limitations or higher deductibles, which could lead to substantial out-of-pocket expenses during accidents. By paying close attention to these details, consumers can better assess whether a quote offers true value in terms of protection and aligns with their personal financial strategies.

In the ever-evolving landscape of auto insurance, staying informed about the nuances of quotes and coverage options can save consumers both time and money while ensuring reliable financial protection on the road.