Home Owners Insurance Homes Insurance » Daily Blog Networks

Homeowners insurance is a crucial component of securing your most valuable asset: your home. It serves as a safety net, protecting homeowners from potential financial losses in the event of unforeseen circumstances such as natural disasters, theft, and accidents on their property. Understanding the various aspects of homeowners insurance can help you make informed decisions when selecting coverage. Below, we will explore the critical elements of homeowners insurance, including the types of policies available, coverage options, deductibles, and how to choose the right policy for your needs.

Types of Homeowners Insurance Policies

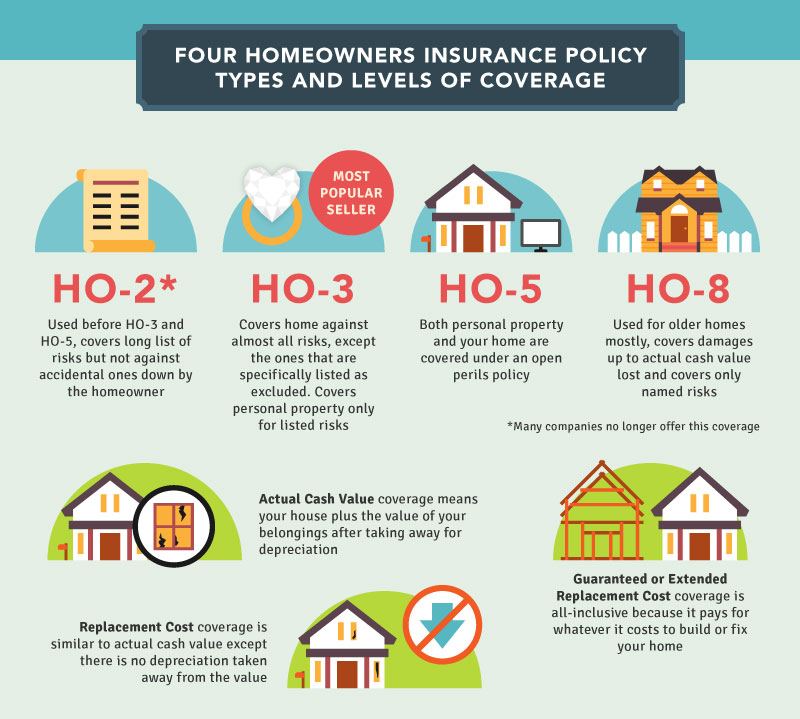

There are several types of homeowners insurance policies, each designed to meet different needs and property types. Understanding these can help ensure you obtain adequate protection. The most common types include:

- HO-1: Basic form coverage, for owner-occupied homes that offers limited protection against specific perils.

- HO-2: Broad form coverage that covers additional perils compared to HO-1, including policies for personal property.

- HO-3: Special form coverage that offers comprehensive protection for both the home and personal property against all perils unless explicitly excluded.

- HO-4: Renters insurance, providing coverage for personal property without covering the structure.

- HO-5: Comprehensive form coverage for higher-value homes, offering more extensive personal property coverage.

- HO-6: Condo insurance designed for condominium owners, covering personal property and improvements.

- HO-7: Similar to HO-3 but for mobile or manufactured homes.

- HO-8: Modified coverage for older homes that may not meet current building codes.

Coverage Options in Homeowners Insurance

A homeowner's insurance policy typically includes several different types of coverage. Understanding these options can be critical for adequately protecting your investment:

- Dwelling Coverage: Protects the structure of your home, including walls, roof, and built-in appliances.

- Personal Property Coverage: Covers personal belongings within the home, such as furniture, clothing, and electronics.

- Liability Protection: Provides financial protection against claims resulting from injuries or damages to others while on your property.

- Additional Living Expenses (ALE): Covers costs incurred if you are temporarily unable to live in your home due to a covered loss.

- Other Structures Coverage: Protects detached structures on your property, such as sheds, garages, or fences.

Importance of Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. It plays a significant role in determining your premium costs:

- Higher Deductibles: Generally result in lower monthly premiums, making them attractive for those looking to save on costs.

- Lower Deductibles: Cost more in premiums but provide a safety net, assisting in potential losses.

- Considerations: When selecting a deductible, consider your financial situation and how much you feel comfortable paying in the event of a loss.

Choosing the Right Policy

Choosing the right homeowners insurance policy can be overwhelming due to the numerous factors to consider. Here are some tips to help navigate your options:

- Assess Your Needs: Evaluate the value of your home and personal possessions to determine the necessary coverage limits.

- Shop Around: Obtain quotes from multiple insurance companies to find a competitive rate and suitable coverage.

- Understand the Policy: Carefully read the policy documents to understand what is covered, any exclusions, and the claims process.

- Ask About Discounts: Inquire if there are discounts available, such as for bundling policies or having safety features in place.

Conclusion

Homeowners insurance is an essential investment for any property owner, offering peace of mind and security against a range of risks. It is important to evaluate your specific needs and choose the appropriate coverage options to protect your home and belongings adequately.

1. What key factors should I consider when selecting a homeowners insurance policy?

When selecting a homeowners insurance policy, consider the value of your home, personal property coverage limits, deductible amounts, liability coverage levels, the specific risks of your location, and any additional endorsements that may enhance your policy. These attributes will provide a framework to make an informed decision about your insurance needs.

2. How can I ensure I am adequately insured against natural disasters?

To ensure adequate insurance against natural disasters, first assess the risks associated with your geographic area, then review your policy to confirm coverage for perils like floods, earthquakes, or hurricanes. Consider adding separate endorsements if standard coverage does not include these risks, and maintain a current inventory of your property for accurate coverage evaluation.

3. What should I do if I need to file a claim on my homeowners insurance policy?

If you need to file a claim on your homeowners insurance policy, document the incident thoroughly with photographs and written notes, then contact your insurance company to report the claim. Follow their procedures and provide all required information. An adjuster may review the damage, and you should maintain records of all correspondence related to your claim for effective management.