Affordable Car Insurance The Best Cheap Car Insurance Best Cheap Car Insurance In Texas For 2021

Finding affordable car insurance can be a daunting process, especially with the myriad of options available in the market today. The cost of car insurance varies greatly depending on various factors including your driving history, coverage needs, and location. Understanding what affordable car insurance entails can help you navigate this complex landscape and ultimately save you money. Here, we will explore various aspects of affordable car insurance, providing you with the knowledge necessary to make informed decisions.

What Is Affordable Car Insurance?

Affordable car insurance refers to policies that provide adequate coverage at a price point that fits within your budget. It's essential to strike a balance between cost and the level of protection you receive. While looking for affordable options, keep the following factors in mind:

- Coverage Limits: Different states require varying levels of coverage. Understand the minimum required by your state and assess your needs based on your driving habits.

- Deductibles: Higher deductibles usually translate to lower premiums. However, ensure you can afford the deductible in case of a claim.

- Discounts: Many insurers offer discounts for safe driving, multiple policies, or even for being a member of certain organizations. Check with your provider to ensure you’re receiving all of the discounts available to you.

- Driver Profile: Your personal profile, including age, driving record, and credit score, can affect rates. Understanding how these factors influence your premiums can help you make strategic decisions.

- Policy Types: Explore different types of policies available such as comprehensive, liability, or collision. Each type has its pros and cons based on your specific needs.

Benefits of Affordable Car Insurance

Choosing affordable car insurance not only helps save you money but also provides you with essential protection. Here are the key benefits:

- Financial Protection: In the event of an accident, having car insurance protects you from paying out-of-pocket for damages and medical expenses.

- Peace of Mind: Knowing that you have coverage in place can alleviate the stress and worry associated with driving.

- Legal Compliance: Most states require drivers to have at least a minimum amount of liability insurance, ensuring you meet legal requirements.

- Customizable Options: Affordable car insurance plans often offer add-ons or customizable options that fit your particular needs.

- Savings Potential: By comparing prices and shopping around, you can find affordable options that don’t skimp on coverage.

How to Find Affordable Car Insurance

Finding affordable car insurance involves research and comparison. Follow these steps to help you secure the best deal possible:

- Shop Around: Don’t accept the first quote you receive. Get multiple quotes from various insurers to compare prices.

- Use Online Tools: Leverage online comparison websites that allow you to compare multiple quotes in one place.

- Review Coverage Needs: Assess your coverage needs carefully. Sometimes basic liability coverage is sufficient, rather than comprehensive policies.

- Consider Bundling: If you have other insurance policies, consider bundling them with the same provider for potential discounts.

- Ask About Discounts: Make sure to inquire about available discounts before finalizing a policy. Different companies offer different incentives.

Common Myths About Affordable Car Insurance

There are numerous misconceptions surrounding affordable car insurance that can lead consumers to make poor decisions. Here are some common myths debunked:

- Myth 1: All cheap insurance is bad insurance.

- Myth 2: Having an older car means you don’t need insurance.

- Myth 3: You can’t get good coverage without paying a premium.

- Myth 4: If you have a perfect driving record, your premium will never change.

- Myth 5: Your credit score doesn’t affect your insurance rates.

What Factors Affect Car Insurance Premiums?

Understanding the factors that influence your insurance premiums can help you adjust your approach to obtaining car insurance. Here are the key factors:

- Your Driving History: A clean driving record can significantly lower your premium rates. On the contrary, accidents and violations can increase rates.

- Your Age and Gender: Younger drivers typically face higher premiums due to inexperience, while statistics show that females may pay less than males.

- Type of Vehicle: The make and model of your vehicle can influence your rates. High-end or sports cars often attract higher premiums.

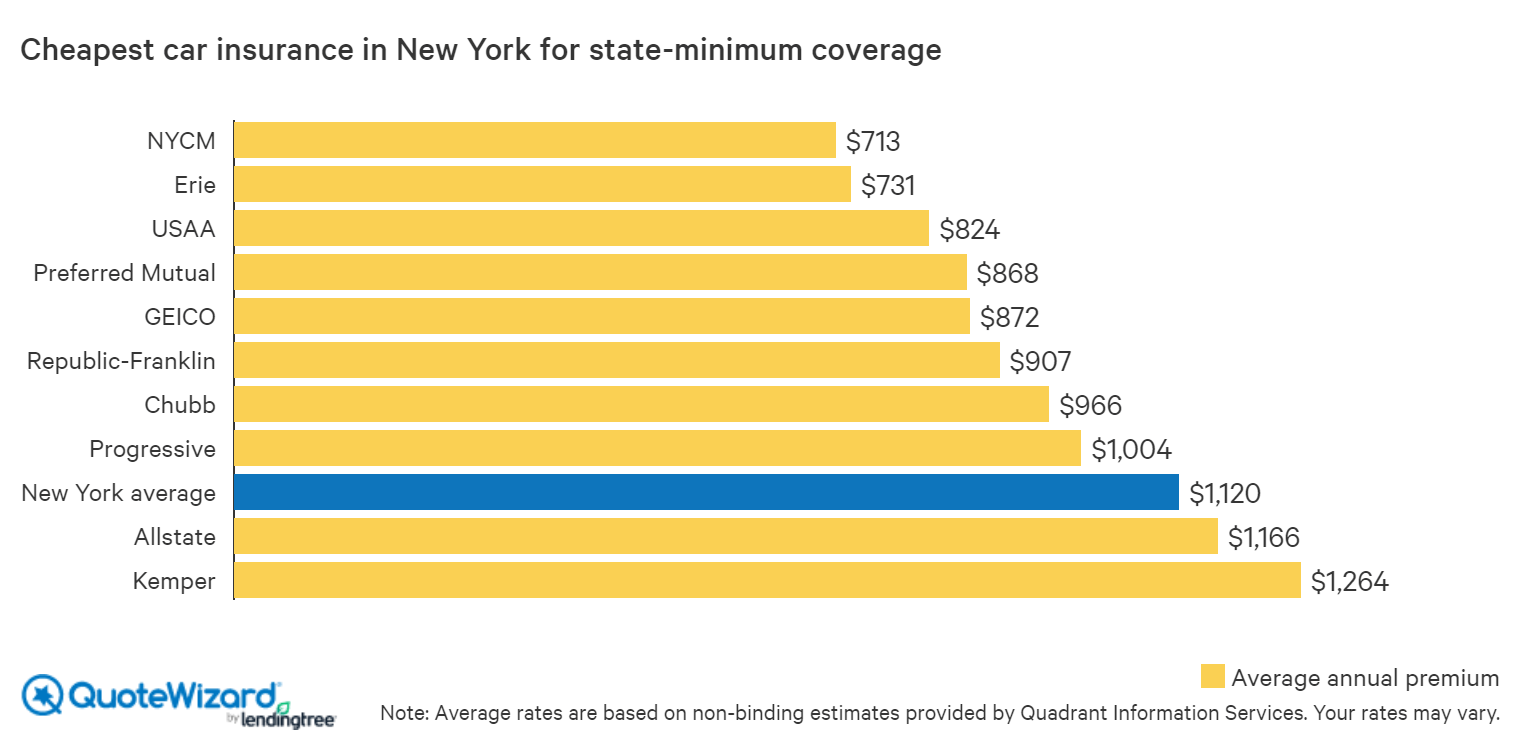

- Location: Where you live plays a crucial role; urban areas with higher crime rates or traffic congestion can lead to higher rates compared to rural ones.

- Claims History: Frequent claims can indicate higher risk, resulting in increased premiums.

Conclusion

Finding affordable car insurance is an essential step for vehicle owners, enabling them to protect their investment while complying with legal requirements. By understanding the various aspects that influence your insurance premiums and being informed about the options available, you can secure a policy that meets your needs without breaking the bank.

1. What should you consider when looking for affordable car insurance?

When searching for affordable car insurance, consider factors such as your coverage limits, deductible amounts, available discounts, your driving profile, and the types of policies that fit your needs. This comprehensive approach ensures you find a balance between adequate coverage and affordability.

2. How can an individual lower their car insurance rates?

To reduce car insurance rates, individuals can shop around and compare different quotes, increase their deductibles, maintain a clean driving record, and take advantage of available discounts for safe driving or bundling policies. These strategies can help manage premium costs effectively.

3. Why is it essential to review your car insurance policy regularly?

Regularly reviewing your car insurance policy is essential to ensure that your coverage aligns with your current needs, that you are receiving the best possible rates, and that you are aware of any changes in policy terms or available discounts. This helps keep your coverage relevant and cost-effective.