Car Insurance Rates Car Insurance Price Per Month

Car insurance rates are a critical topic for many drivers, as they can have a significant impact on one's financial planning. Understanding these rates is essential in ensuring that you are adequately covered while not overpaying for your insurance. Below, we explore various factors that influence car insurance rates, major trends in the industry, statistics, and hints on how to potentially lower costs.

- Factors Influencing Car Insurance Rates:

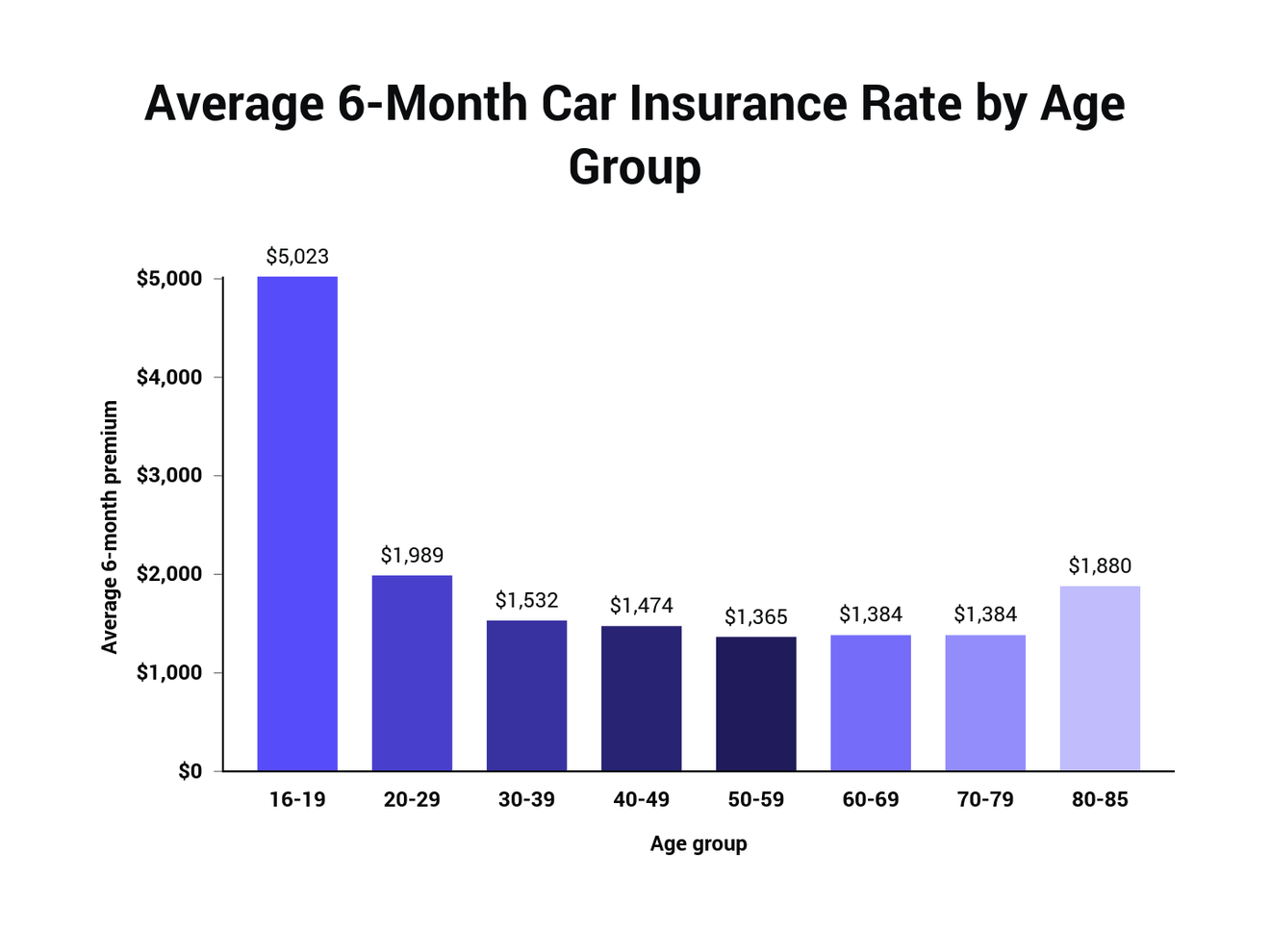

- Driver's Age: Younger drivers, particularly those under the age of 25, typically have higher insurance rates due to their inexperience on the road. Statistically, this age group is more prone to accident claims.

- Driving Record: A driver with a clean record will generally benefit from lower rates, while speeding tickets, accidents, and other violations can lead to increased premiums.

- Vehicle Type: The make and model of a vehicle can significantly affect rates. For instance, sports cars or luxury vehicles usually incur higher costs due to the perceived risk and repair costs.

- Location: Insurance rates can vary by location; urban areas with higher crime rates or accident statistics often yield more expensive premiums compared to rural areas.

- Coverage Levels: The extent of coverage chosen will directly affect the rates. Comprehensive or full coverage will generally be more expensive than basic liability insurance.

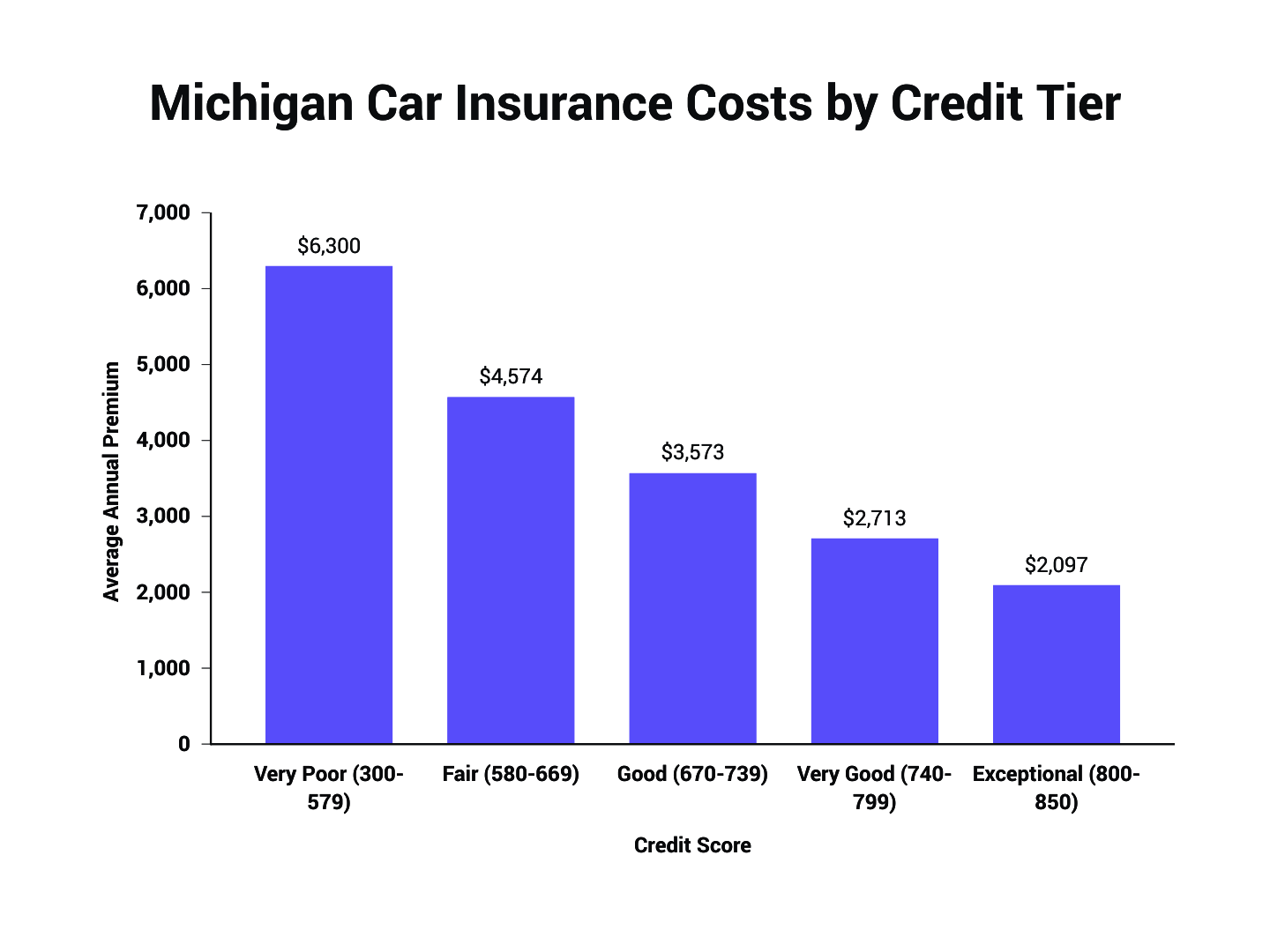

- Credit Score: A driver's credit score can also impact their insurance rates. Lower credit scores may lead to higher premiums as they are perceived as higher risk by insurers.

Understanding these factors is crucial as they play an integral role in calculating your premiums. However, it is essential to look beyond these individual aspects and observe the overarching trends in the car insurance industry.

- Major Trends in Car Insurance Rates:

- Rising Premiums: Recent statistics suggest a continuous rise in car insurance rates. Compounded by rising repair costs, the average price of a car insurance policy is expected to increase steeply in the coming years.

- Shift Towards Usage-Based Insurance: With advancements in technology, usage-based insurance plans are becoming more popular. Insurance companies now often offer policies that base rates on actual driving behavior rather than demographic factors alone.

- Impact of the Pandemic: The COVID-19 pandemic has altered driving patterns, leading to different claims experiences. Some insurers offered premium rebates as driving decreased, but rates are bouncing back as more motorists return to the road.

- Increased Focus on Customer Service: In light of customer expectations, insurance companies are prioritizing improved customer service and digital solutions for policy management.

Having a strong grasp of these trends and factors can empower you as a consumer. Furthermore, many individuals are looking for ways to lower their insurance costs without compromising their coverage. Below are some tips on how to decrease your car insurance rates:

- Shop Around: Always compare rates from different insurance providers. Many companies offer online quotes, which can help you identify the best deal tailored to your needs.

- Discounts: Inquire about discounts that may be applicable based on various factors, such as bundling policies, safe driving records, or completing defensive driving courses.

- Review Coverage: Assess whether your current coverage is necessary. For older vehicles, it might not make sense to keep full coverage. Adjusting to only liability can save money.

- Increase Deductibles: If you can afford it, opting for a higher deductible can lower your premium significantly. Just ensure that you can cover the cost in the event of a claim.

- Maintain Good Credit: Work on maintaining or improving your credit score, as better scores often translate into lower insurance premiums.

In conclusion, navigating the world of car insurance rates can be complex, but by understanding the factors that influence these rates and staying updated on industry trends, consumers can make more informed decisions. Establishing good driving habits, maintaining a clean record, and proactively seeking ways to lower costs are crucial steps in managing your car insurance effectively.

What factors significantly influence the rates of car insurance?

Car insurance rates are primarily influenced by various factors, including the driver's age, location, driving history, type of vehicle, coverage level, and credit score. Each of these factors contributes to the overall risk assessment performed by insurers, determining the premium costs associated with offering the policy.

How can a driver reduce their car insurance premiums effectively?

A driver can effectively reduce their car insurance premiums through various methods: shopping around for the best rates, taking advantage of available discounts, reassessing their coverage levels, increasing deductibles as financial situations allow, and maintaining strong credit scores. Each of these strategies can lead to significant savings on insurance costs.

What role does the type of vehicle play in determining insurance rates?

The type of vehicle plays a significant role in determining insurance rates. Vehicles with higher market values, higher performance capabilities, or those that are more frequently stolen tend to incur higher insurance premiums. Conversely, vehicles that are recognized for safety and lower repair costs often attract more favorable rates due to their reduced risk profile.

How does a driver's location impact their car insurance rates?

A driver's location has a considerable impact on car insurance rates because areas with higher crime rates or accident frequency are associated with increased risks. Therefore, insurance companies may charge higher premiums for policies in such regions to compensate for the greater likelihood of claims relative to safer, rural locations.

By gaining insights into these aspects, individuals can navigate the car insurance landscape more successfully. It is essential to remain informed and proactive to ensure that you receive the best possible coverage at the most affordable price.