Pet Insurance Comparison Pet Shield

Pet insurance is an essential consideration for pet owners, as it provides financial protection against unforeseen veterinary expenses. With the growing number of providers and policies available in the market, comparing pet insurance plans has become increasingly important. This article will delve into the key features of pet insurance comparison, the factors to consider when assessing different policies, and the benefits of having pet insurance.

When considering pet insurance, here are some vital points to understand:

- Types of Coverage: Pet insurance policies can vary significantly in terms of coverage. Common types include:

- Accident-Only Coverage: This pays for injuries that result from accidents.

- Illness Coverage: This covers costs associated with illnesses, including chronic conditions.

- Comprehensive Coverage: This type usually combines both accident and illness coverage.

- Inclusions and Exclusions: It's crucial to understand what is included in a policy. Many plans will cover vaccinations, wellness checks, and emergency care, while others may exclude certain pre-existing conditions or breed-specific issues.

- Coverage Limits: Policies may come with annual, per-incident, or lifetime limits on reimbursement. It's essential to determine how much coverage is adequate based on your pet's health needs.

- Deductibles: Each policy will have a specified deductible amount that must be paid out-of-pocket before insurance kicks in. Understanding the deductible structure is vital for cost estimation.

- Premium Costs: Monthly premiums can vary widely based on the extent of coverage, your pet's age, and breed. Comparative analysis helps find a balance between affordability and comprehensive coverage.

- Provider Reputation: Researching insurance providers for their claim processing efficiency, customer service, and overall reputation in the market is essential.

- Waiting Periods: Most policies have waiting periods for various types of claims. Understanding these timelines can help in making informed decisions.

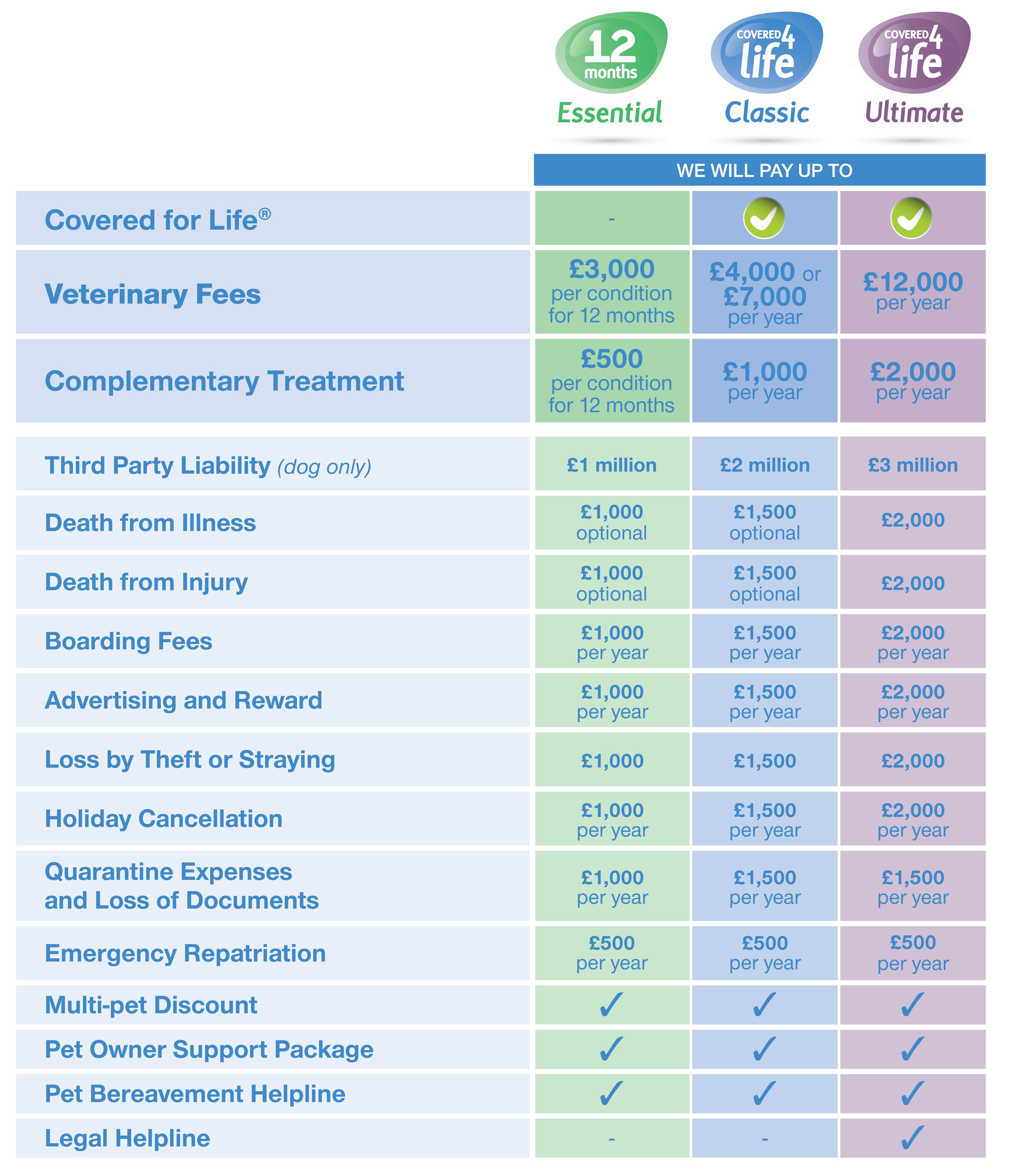

New look pet insurance policies keep Petplan well in front of the market

Petplan has updated its policies to stay competitive in the growing pet insurance market. By refining their coverage options and simplifying the claims process, they aim to maintain their market-leading status. It is vital for pet owners to review these updated offerings to ensure they select the right plan for their pet's needs.

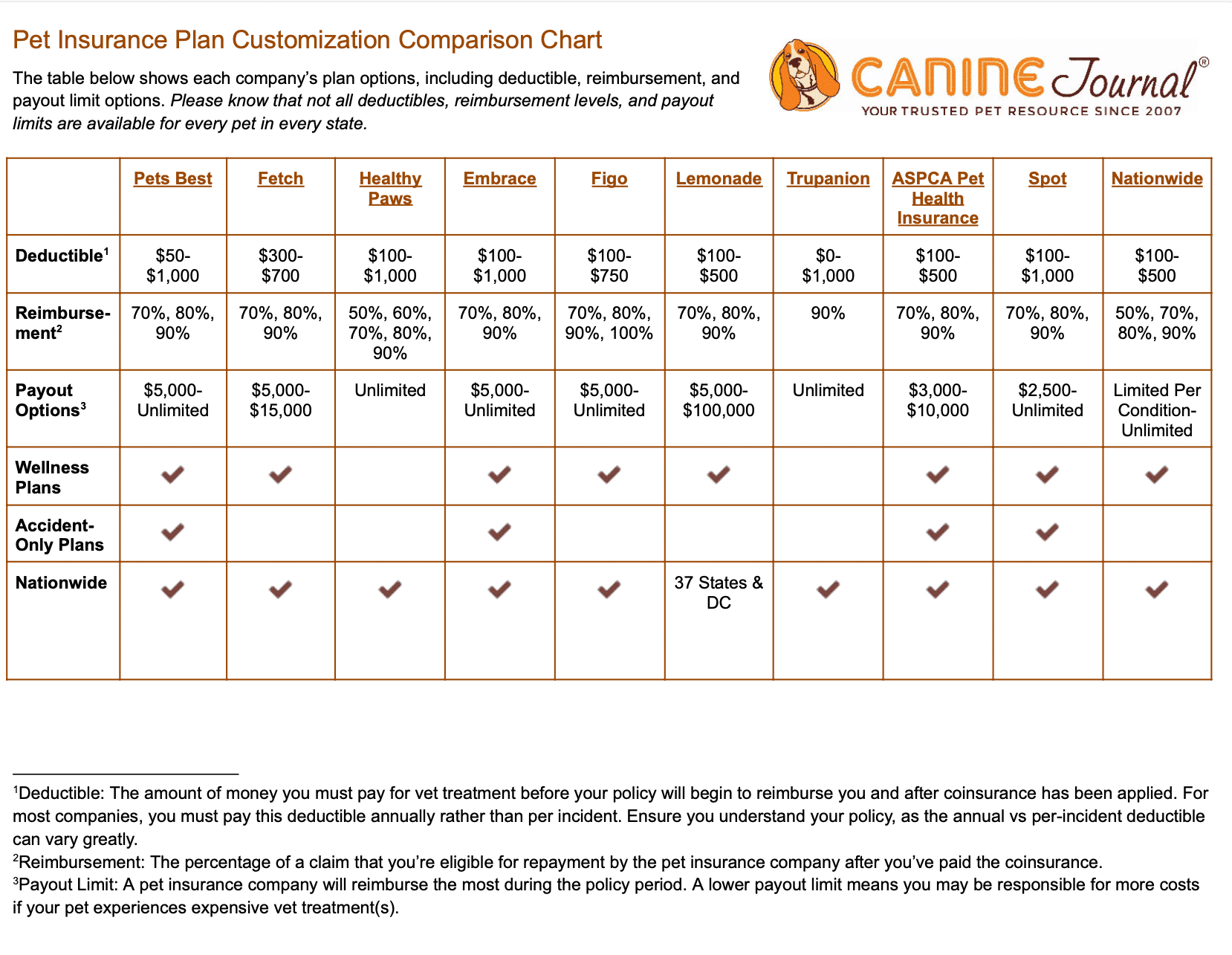

Pet Insurance Comparison Charts (2024): Compare Quotes, Plans, Coverage

The year 2024 has ushered in a multitude of updates in the pet insurance landscape. Various comparison charts now exist to assist pet owners in evaluating quotes, plans, and coverage options side by side. This helps identify which policies provide the most comprehensive benefits at competitive prices.

Pet Insurance Providers. Which One Is Best For Your Dog? - My Brown Newfies

Choosing the best pet insurance provider often depends on various individual factors. A comparative analysis involving coverage options, provider reliability, and customer service reviews can significantly aid in decision-making. Consulting comprehensive guides or databases can provide critical insights into which provider is most suitable for your dog's specific health considerations.

30 Best Pictures Pet Insurance Comparison Chart 2020 : The Complete Pet

Historical charts like those from 2020 can provide perspective on how pet insurance offerings have evolved over time. Examining past data not only helps understand trends but also marks the significant advancements in coverage options that different providers are willing to offer, allowing potential customers to make more informed choices.

PET INSURANCE COMPARISON CHART | Insurance comparison, Pet insurance

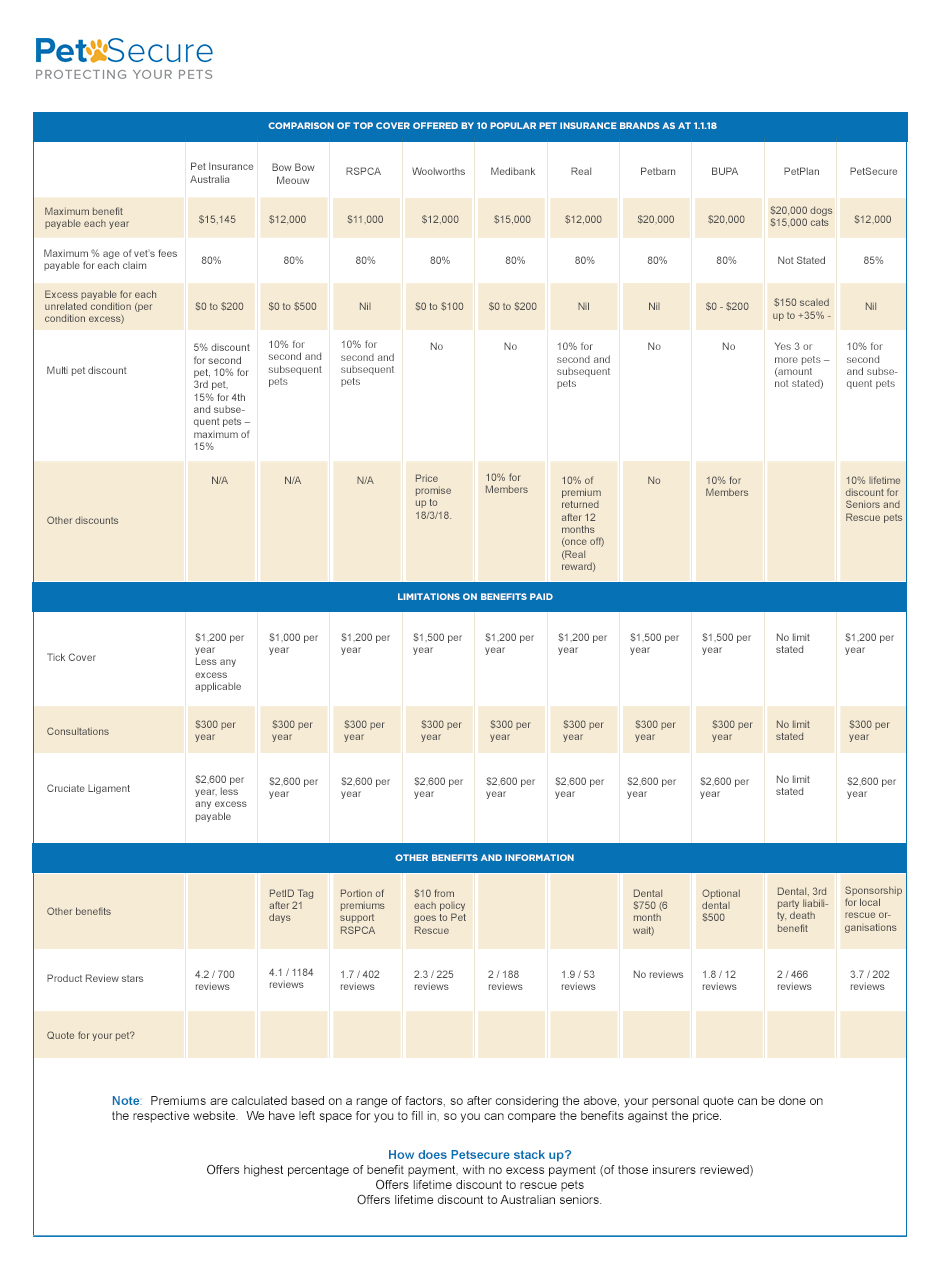

Visual representation through comparison charts simplifies complex information, making it accessible for pet owners. By leveraging these resources, individuals can dissect myriad policies and quickly ascertain which components align with their budgeting and healthcare needs for their pets.

Guide to Pet Insurance in Australia - PetSecure

In regions like Australia, specific guides cater to local pet insurance needs. These guides often feature region-specific providers and common coverage requirements, equipping pet owners with localized knowledge to make the best choices for their pets’ welfare.

The discussion around pet insurance comparison leads to critical inquiries regarding coverage adequacy. What factors should be considered when selecting a pet insurance policy?

When selecting a pet insurance policy, one must consider several factors, including the type of coverage provided (such as accident-only versus comprehensive), the inclusions and exclusions of each policy, coverage limits (whether annual, per-incident, or lifetime), deductible amounts, and the total cost of premiums. Furthermore, researching the reputation and service quality of the provider can impact the decision significantly.

Another important question that arises is, How do pet insurance premiums vary based on specific factors?

Pet insurance premiums typically vary based on factors such as the age and breed of the pet, the type of coverage chosen, geographical location, the extent of the coverage limits, and the deductible levels selected by the owner. Insurance companies assess these aspects to determine the risk level and charge accordingly to maintain profitability while still providing essential coverage.

Finally, one may wonder, What are the long-term benefits of investing in pet insurance?

Investing in pet insurance provides numerous long-term benefits, notably peace of mind knowing that unexpected veterinary expenses will be covered. It enables pet owners to make healthcare decisions based on the pet's needs rather than financial limitations. Furthermore, pet insurance can lead to potential savings in the long run, as it may cover costly emergencies that would otherwise strain a household budget considerably.