Cheap Insurance Car Top 10 Cheapest Car Insurance Companies

Car insurance is an essential aspect of vehicle ownership, providing financial protection against losses due to accidents, theft, and other unforeseen events. With so many options available on the market, finding affordable car insurance can be a daunting task for many consumers. In this article, we will explore the various aspects of cheap car insurance, including factors that influence its cost, types of coverage available, and tips for finding the best deals.

Understanding the dynamics of cheap car insurance can empower consumers to make informed decisions that can save them significant amounts of money. Here are several key points to consider:

- Types of Coverage: Car insurance comes in various forms, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Understanding each type of coverage and what it protects against can help you find the right balance of protection and cost.

- Factors Influencing Premiums: Numerous factors contribute to the cost of car insurance premiums, including the driver’s age, driving history, the type of vehicle, location, and credit score. Knowing how these factors affect your premiums can help you negotiate better rates.

- Discounts and Offers: Many insurance providers offer discounts for various reasons, such as good driving records, multiple policy bundles, or membership in certain organizations. Taking advantage of discounts can significantly lower the overall cost of your insurance.

- Comparing Quotes: It's crucial to shop around and compare quotes from multiple insurance companies. Different insurers have varying pricing structures and criteria for assessing risk, which can lead to substantial differences in premiums.

- State Regulations: Insurance requirements can vary significantly from one state to another. Be aware of your state's minimum coverage requirements and regulations, as this can influence your decision when selecting an insurance plan.

Image: Cheap Car Insurance Concept

As you embark on your quest for affordable car insurance, keep in mind the importance of thoroughly researching potential insurers. Every driver's situation is unique; therefore, what works for one may not work for another. Look for a balance between cost and coverage that works for your individual needs.

Image: Best Cheap Car Insurance Companies

Many consumers may wonder, "What is the best way to find cheap car insurance?" The answer lies in conducting diligent research, utilizing online comparison tools, and seeking out insurance agencies that cater to your specific needs while offering competitive rates.

Image: Insurance for a New Car Quote

Consider also the use of technology in the search for cheap car insurance. Many apps and online platforms enable users to connect with insurers and receive quotes instantaneously. This method not only streamlines the process but often reveals discounts that might not be available through traditional routes.

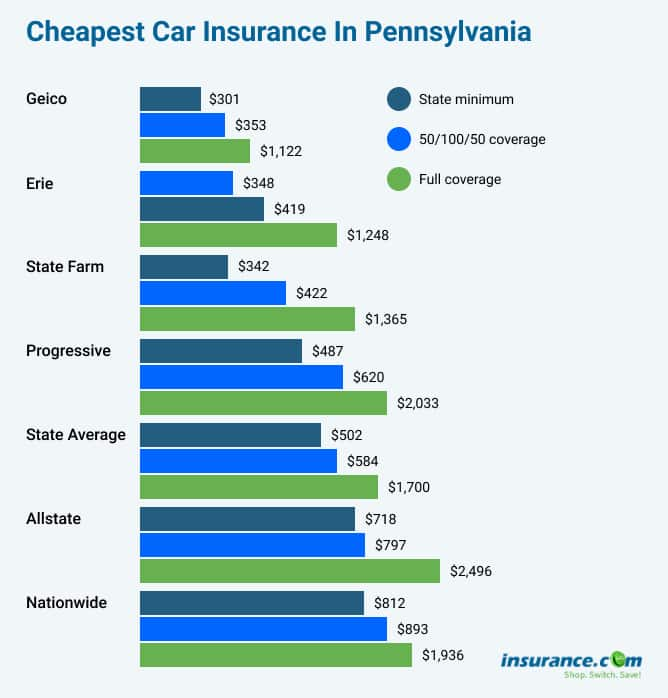

Image: Cheapest Car Insurance in Pennsylvania

In terms of regional pricing, it's essential to understand that car insurance rates can vary greatly depending on your location. Comparing rates across various states or even neighborhoods can lead to a clearer picture of which insurers provide the best deals based on specific regional criteria.

Image: Best Cheap Car Insurance in Texas

Ultimately, the goal of seeking cheap car insurance is to protect yourself without breaking the bank. Make sure to revisit your coverage options annually or when significant life changes occur (like getting married or moving) to ensure you’re still getting the best rates for your situation.

Image: Cheap Car Insurance Quotes

As we broadening the scope of our understanding regarding cheap car insurance, it’s vital to keep in mind that low premiums shouldn't come at the price of inadequate coverage. Always ensure your policy includes the necessary protections tailored to your personal circumstances. With these strategies in mind, navigating the world of car insurance can be less overwhelming and more rewarding.

1. What factors influence the cost of cheap car insurance?

The cost of cheap car insurance is influenced by several key factors, including the driver's age, driving history, vehicle type, geographic location, and credit score. Insurers assess these elements to evaluate risk and determine premium rates, which can lead to variability in pricing among different customers.

2. How can drivers find the most affordable car insurance policy?

Drivers can find the most affordable car insurance policy by comparing rates from multiple insurance providers, seeking out discounts, assessing coverage levels, and using technology to streamline the quote process. Engaging with online platforms that allow for real-time comparisons and assessment ensures that consumers get the best value for their coverage needs.

3. What role do discounts play in reducing car insurance costs?

Discounts play a significant role in reducing car insurance costs by providing policyholders with lower premium rates based on specific criteria, such as safe driving, bundling multiple policies, and qualifying for group memberships. Utilizing these discounts effectively can lead to considerable savings on overall insurance expenses.