Cheapest Auto Insurance 8 Ways To Get The Cheapest Car Insurance Possible

Cheapest auto insurance is an essential topic for many drivers seeking to balance cost and coverage. With various insurance providers and plans available, finding the optimal policy can seem daunting. Understanding the factors that contribute to cheaper auto insurance rates is crucial for making informed decisions. Here are some key considerations:

- Driving Record: Your driving history significantly impacts your insurance premiums. Safe driving habits can lead to discounts, while accidents or violations may increase your rates.

- Policy Coverage: The extent of coverage you choose will affect your premium. Liability coverage is typically cheaper, while comprehensive and collision coverage add to costs.

- Deductibles: A higher deductible typically results in lower premiums. However, it’s essential to consider how much you can afford to pay out-of-pocket in the event of a claim.

- Location: The state and area where you live can greatly influence your rates. Urban areas often face higher premiums due to increased theft and accident rates compared to rural areas.

- Vehicle Type: The make and model of your car determine insurance rates. Sports cars or high-value vehicles generally carry higher premiums, while sedans and trucks might be cheaper to insure.

- Multi-Policy Discounts: Bundling various types of insurance, such as home and auto, can lead to significant savings on your premiums.

- Age and Experience: Younger, inexperienced drivers typically face higher rates. Conversely, mature drivers with a long history of safe driving often receive discounts.

- Credit Score: Many insurers check credit scores when calculating premiums. A higher credit score can lead to lower rates, reflecting a lower risk for the insurer.

- Usage-Based Insurance: Some companies offer discounts for low-mileage drivers through telematics. This can be an excellent option for those who drive infrequently.

When searching for the cheapest auto insurance, it's advisable to obtain quotes from multiple providers. This allows you to compare coverage options, premiums, and available discounts. Additionally, consider speaking with an insurance agent who can provide personalized advice based on your specific situation.

Image 1

According to ValuePenguin, Washington state offers some of the best cheap car insurance rates available in 2022. Their findings illustrate how consumers can save by understanding regional variances in insurance costs.

Image 2

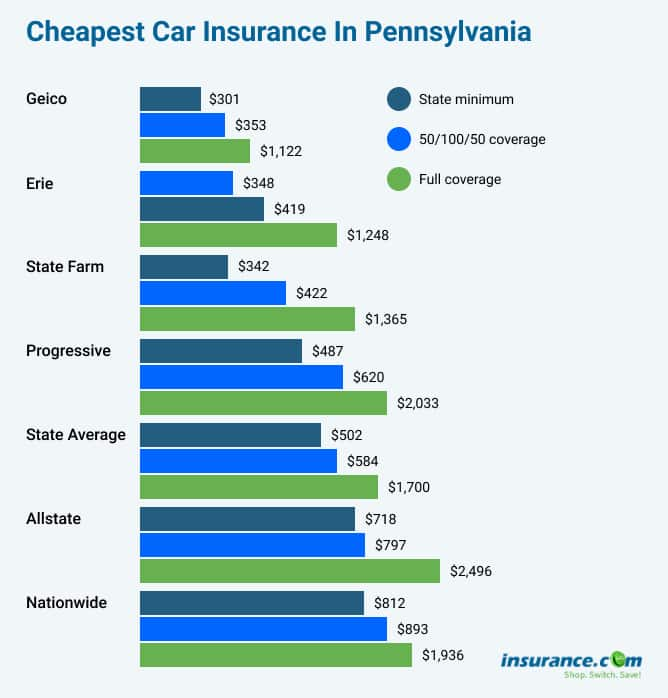

Insurance.com highlights the cheapest car insurance rates in Pennsylvania, emphasizing the importance of comparing quotes by company for potential savings.

Image 3

Young drivers can significantly benefit from understanding the strategies to obtain cheap car insurance. Various tips and tricks can reduce their overall costs, making it easier to manage expenses.

For car insurance consumers, the type of coverage can greatly affect rates. Liability insurance, which covers damage to others, is generally more affordable than comprehensive or collision coverage. However, comprehensive and collision are essential for those who want to protect their own vehicle. Balancing between what you need and what you can afford is pivotal when determining the right level of coverage.

Image 4

There are several tips to enhance your chances of securing the cheapest car insurance quotes. These include comparing prices, adjusting your coverage, maintaining a clean driving record, and exploring available discounts.

Image 5

YouTube offers various resources covering the top ten cheapest car insurance companies. Understanding which companies provide the best rates is critical for informing your purchasing decisions.

Image 6

In Toronto, being equipped with a cheap car insurance calculator can help drivers make informed choices regarding their insurance options. It allows users to compare costs effectively.

In light of the dynamic insurance landscape, it's crucial to stay updated on market trends. Awareness of new regulations, emerging technologies, and shifts in consumer behavior can all influence price structures and available options in the cheap auto insurance sector.

1. What are the most effective strategies for reducing auto insurance premiums?

Implementing a combination of strategies can effectively reduce auto insurance premiums. First, maintain a clean driving record to avoid penalties associated with accidents or violations. Next, consider increasing your deductible, which typically translates to lower monthly payments. Finally, explore bundling your insurance policies for multi-policy discounts.

2. How does credit history affect auto insurance rates?

Insurance companies often use credit history as a determining factor for auto insurance rates. A positive credit score typically indicates responsible financial behavior, which insurers equate to lower risk. Thus, individuals with favorable credit histories usually enjoy more competitive rates compared to those with poor credit backgrounds.

3. Can vehicle safety ratings influence insurance costs?

Yes, vehicle safety ratings can greatly influence insurance costs. Cars with higher safety ratings are often seen as lower risk by insurers, which can result in cheaper premiums. Features such as anti-lock brakes, airbags, and advanced driver-assistance systems contribute significantly to a vehicle's safety rating and can lead to discounts on insurance premiums.