Compare Car Insurance Car Insurance Quotes Texas

When looking to purchase car insurance, one of the most critical steps is to compare different policies from various insurance providers. With numerous options available in the marketplace, it can become overwhelming and time-consuming to evaluate each one comprehensively. Here, we dive deep into the process of comparing car insurance to help you make a well-informed decision.

The process of comparing car insurance entails understanding the coverage options, costs, and various other factors that come into play. Here are the key elements to consider when comparing car insurance:

- Coverage Types: It is essential to recognize the type of coverage you need. Options typically include:

- Liability Coverage: This covers damages to others in accidents you cause.

- Collision Coverage: This covers damage to your car in an accident, regardless of who is at fault.

- Comprehensive Coverage: This protects against non-collision-related incidents, like theft or natural disasters.

- Personal Injury Protection: This covers medical expenses for you and your passengers regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides coverage if you're in an accident with an uninsured driver.

- Premium Costs: Understanding how much you'll pay monthly is vital. Different factors influence premiums, including:

- Driving history

- Age and gender

- Credit score

- Type of vehicle

- Location

- Deductibles: Determine what deductible you can afford. A higher deductible usually results in a lower premium but requires more out-of-pocket costs in the event of a claim.

- Discounts: Many providers offer various discounts. Consider:

- Safe driver discounts

- Multi-policy discounts

- Good student discounts

- Low mileage discounts

- Financial Stability and Reputation: Research the insurance companies to ensure they have a reliable financial standing and a good reputation for customer service. You can refer to ratings by agencies such as A.M. Best or J.D. Power.

Now that you have a broad understanding of the factors in comparing car insurance, here’s a closer look at specific questions that often arise during this process:

How can I effectively assess different car insurance policies?

Assessing different car insurance policies involves identifying your coverage needs first, reviewing policy options offered by various insurance providers, comparing their premiums, analyzing included benefits, and reading reviews from other customers for insight into the company’s claims process and customer service.

What are the common pitfalls to avoid when comparing car insurance?

Common pitfalls include failing to read the fine print which may hide critical exclusions, getting quotes without representing your accurate information leading to unexpected premium costs, and not considering the overall value of the coverage provided instead of solely focusing on the lowest price.

What role do state regulations play in car insurance comparison?

State regulations influence the minimum coverage requirements, insurer practices, and consumer rights concerning auto insurance. Understanding your state’s laws helps ensure that you compare policies compliant with those regulations, allowing for an adequate assessment of coverage and avoiding potential legal issues.

Visual Aids for Comparing Car Insurance Options

To aid in your understanding, here are some relevant visual aids that can help frame your comparison process:

One Stop Car Insurance Shopping - Family Fun Journal

This visual emphasizes the importance of evaluating different car insurance options in one place, highlighting their comparative features clearly.

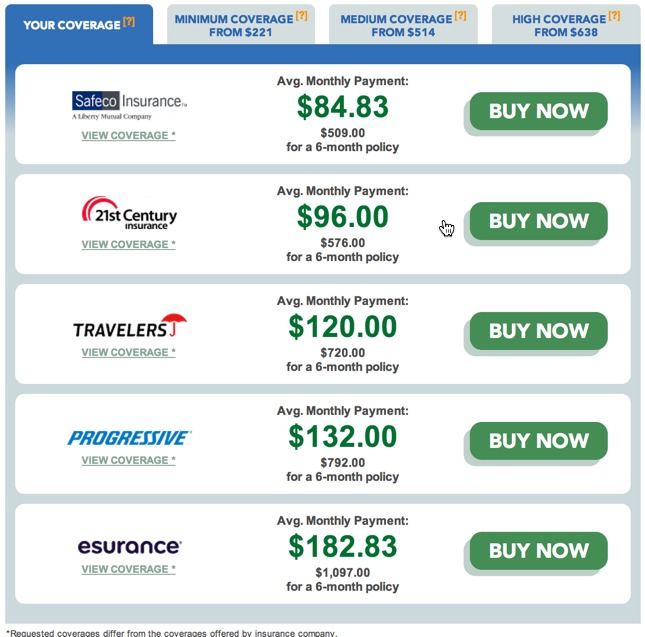

Insurance world: Car Insurance Best Rates

This chart provides a straightforward view of the various rates available, allowing consumers to make quick comparisons.

Car Insurance Quotes Texas - mistazam-pointofview

This image showcases how car insurance quotes vary by state, particularly focusing on Texas.

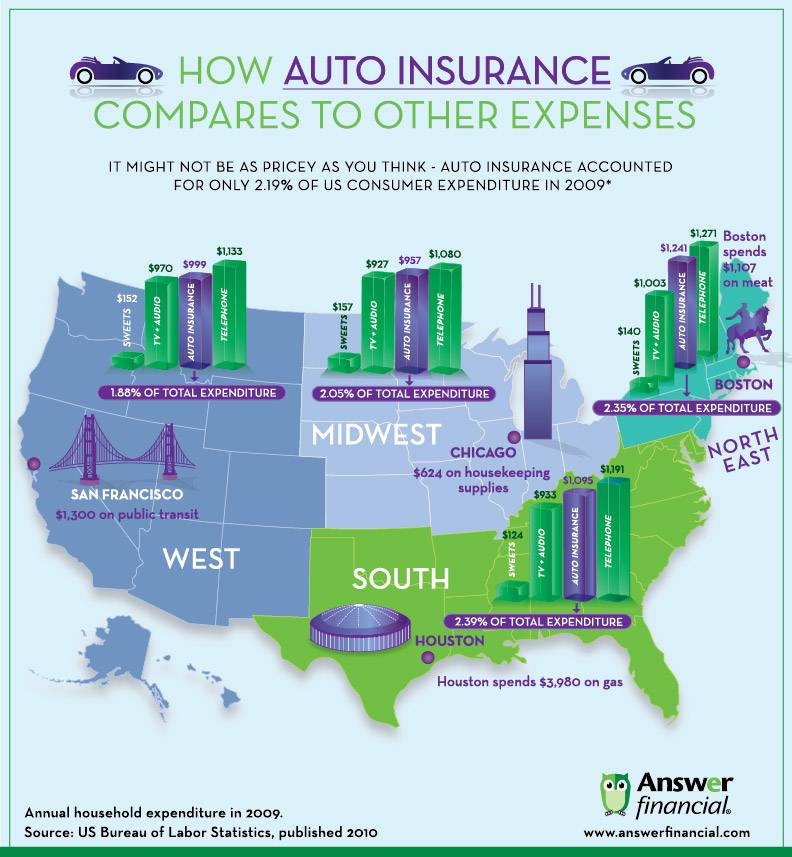

Multiple Auto Insurance Quotes Comparison. QuotesGram

The infographic depicts the differences in auto insurance quotes, giving a visual representation of the varying premiums.

How to Compare Car Insurance Companies - Quote.com®

This guide illustrates steps to effectively compare car insurance companies, serving as a checklist for potential purchasers.

Insurance Comparison For Cars - auto.teknodaring

This visual not only outlines the components of car insurance comparison but also explains their significance in the purchasing decision.

This HTML formatted document provides a comprehensive overview of how to compare car insurance, with added visual elements to enhance understanding and interest. Each section dives into important factors, questions, and visual aids related to the topic.