Insurance Quotes Car How To Compare Car Insurance Quotes (updated 2023)

Car insurance is an essential component of responsible vehicle ownership. When searching for car insurance, obtaining multiple quotes is crucial, as it allows drivers to compare coverage options and prices from various providers. Understanding how to navigate the process of acquiring insurance quotes can save money and ensure better coverage tailored to individual needs.

Here are several important aspects to consider when dealing with car insurance quotes:

- Coverage Options: When requesting quotes, it is vital to understand different types of coverage available, including liability, comprehensive, collision, and uninsured/underinsured motorist coverage.

- Liability Coverage: Protects against costs arising from accidents where you are found at fault.

- Comprehensive Coverage: Covers damages to your vehicle that are not the result of a collision, such as theft or natural disasters.

- Collision Coverage: Pays for damages to your own car after an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Provides financial protection if you are in an accident with someone who has inadequate insurance.

- Comparing Quotes: Always gather multiple quotes from different providers. Each may offer varying premiums and coverage limits.

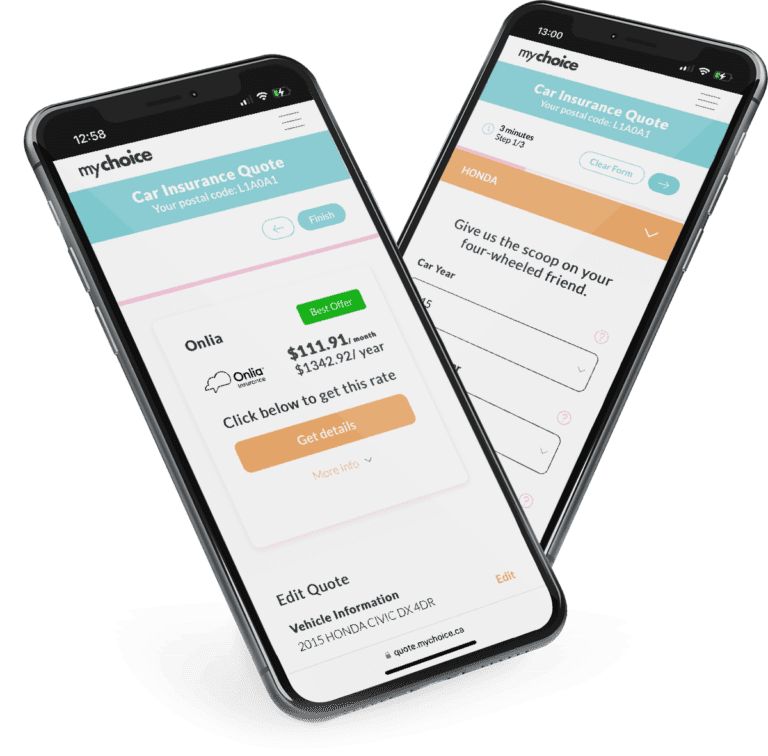

- Consider using online comparison tools to streamline the process.

- Ask insurance agents about any discounts you may be eligible for, such as bundling policies, safe driver discounts, or low mileage discounts.

- Understanding Premiums: The premium amount will depend on various factors, including your driving history, location, age, and type of vehicle.

- Young drivers, for instance, often face higher premiums due to perceived risk.

- High-performance cars typically come with increased insurance costs.

- Claim Process: Familiarize yourself with how the insurance claims process works for each provider before selecting a quote.

- Read reviews or testimonials regarding claims experiences with each insurer.

- Check the average time it takes for claims to be processed and paid out.

When looking into car insurance quotes, it's also wise to assess the financial stability of the insurance company. Ratings from agencies such as A.M. Best or Standard & Poor’s can inform you of the insurer’s ability to pay claims.

In conclusion, obtaining car insurance quotes is an essential step for any vehicle owner. By thoroughly understanding coverage options, comparing quotes, and knowing how premiums are calculated, consumers can make informed decisions that meet their needs. Additionally, understanding the claims process can help avoid frustrations in the event of an accident.

Understanding Car Insurance Quotes

The process of acquiring car insurance quotes can be complicated; however, breaking it down into manageable steps makes it easier. Knowledge about coverage options, understanding how quotes differ, and recognizing the implications on premiums are integral to making a wise choice.

Why Do You Need Multiple Insurance Quotes?

By securing multiple quotes, you can compare different policy offers, which may result in significant savings on premiums. It empowers you to choose a policy that suits your specific needs while ensuring you are not overpaying for coverage you don't require.

In the quest for the best car insurance, one question might arise: "What factors impact my car insurance premium?"

Factors that impact your car insurance premium include your driving record, vehicle type, location, age, and credit score. Each of these elements contributes to how insurance companies evaluate risk—your driving history indicates your likelihood of filing a claim, while your vehicle's make and model can affect repair costs and theft risk.

Another question to consider is: "How often should I review my car insurance policy?"

It is advisable to review your car insurance policy at least once a year or whenever you experience a significant life change, such as moving, getting married, or purchasing a new vehicle. Regular reviews ensure that you are still getting the best coverage for your current circumstances and may uncover new discounts or better rates.

Lastly, one might ask: "What is the difference between full coverage and liability-only car insurance?"

Full coverage typically includes liability, comprehensive, and collision insurance, providing extensive protection against various risks. In contrast, liability-only insurance covers damages to other people’s property and medical expenses if you are at fault in an accident, leaving you financially responsible for repairs to your own vehicle. Understanding these differences can significantly affect your financial safety following an accident.