Car Insurance Quote Insurance Car Sample Quotes Auto Progressive Quotesgram Form

Car insurance quotes are essential for anyone looking to protect their vehicle and finances. In an ever-fluctuating market, understanding the types of coverage, comparing quotes, and knowing how to find the best deal are crucial elements for drivers. Here’s a comprehensive overview of what car insurance quotes are, why they matter, and how to navigate the process effectively.

When it comes to car insurance, quote comparison is a powerful tool. To help you grasp the importance and complexity of the car insurance market, consider the following:

- Understanding Car Insurance: Car insurance provides financial protection against various risks, such as accidents, theft, and damages. It is a legal requirement in most states, ensuring that drivers can cover the costs if they are at fault in an accident.

- Types of Car Insurance: Different types of coverage include liability insurance, collision coverage, comprehensive coverage, personal injury protection, and uninsured/underinsured motorist coverage. Each serves a unique purpose and comes with varying costs and benefits.

- Factors Affecting Insurance Quotes: Several factors influence the quotes you receive, including but not limited to:

- Your driving record

- Location

- Type and age of the vehicle

- Your credit score

- Annual mileage

- Coverage amount and deductible choices

- Importance of Comparing Quotes: Comparing quotes allows you to understand the market landscape, uncover potential savings, and make informed decisions. A small difference in premium can mean significant savings over the course of a year.

- How to Obtain Quotes:

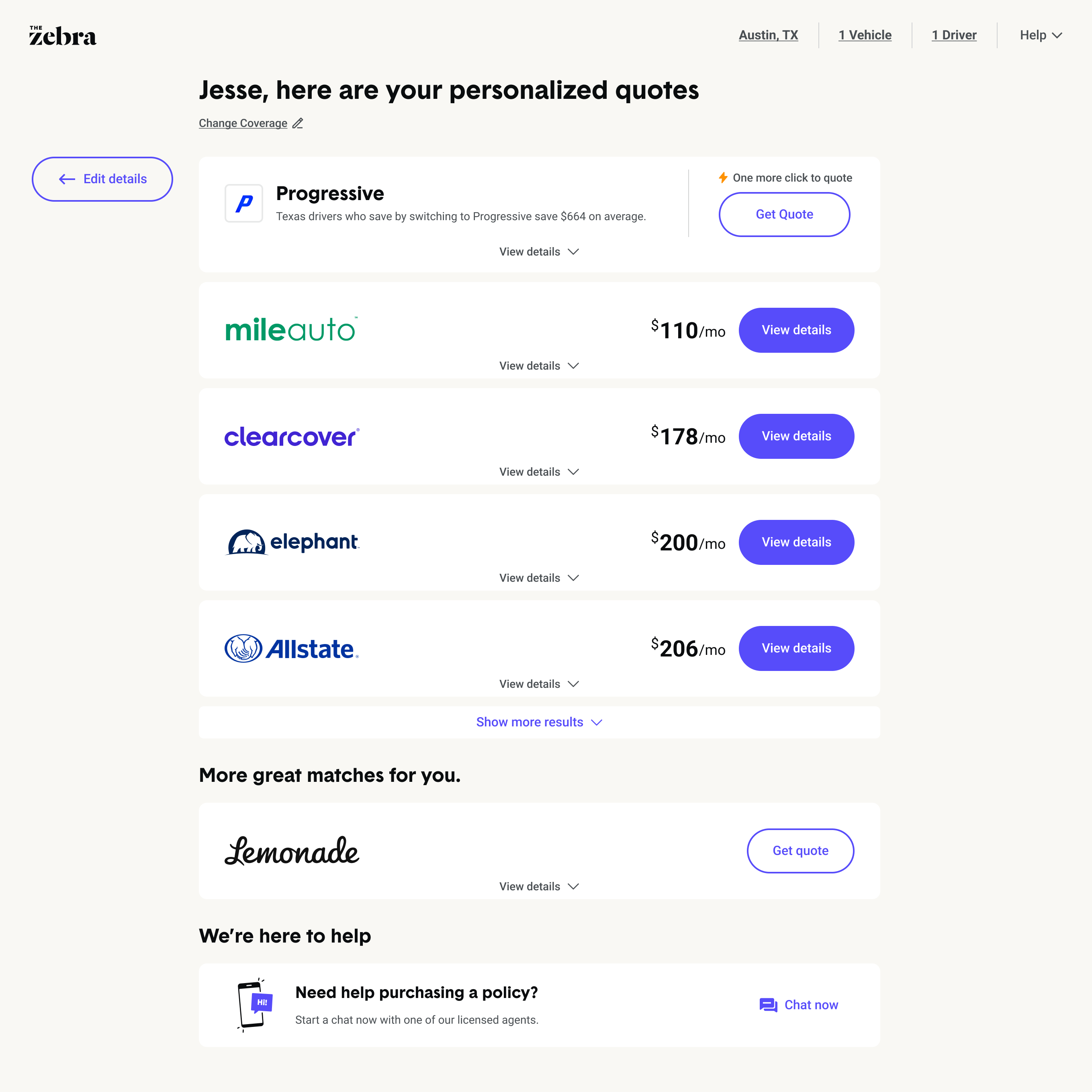

- Online Quote Tools: Websites like The Zebra provide instant quotes tailored to your needs.

- Insurance Agents: Local agents can offer personalized services and guidance.

- Direct Insurers: Companies like GEICO or Progressive allow users to obtain quotes directly from their websites.

- Understanding Terms: Familiarize yourself with terms often found in quotes, such as premiums, deductibles, and coverage limits, to help you make informed decisions and avoid surprises.

- Reviewing Policy Details: Beyond the quote, always read the fine print of any policy. Not all insurance products are the same; some might offer better value than others despite apparent similarities in premium costs.

- Common Mistakes:

- Not shopping around for quotes.

- Choosing the lowest premium without understanding coverage options.

- Failing to update insurance information regularly.

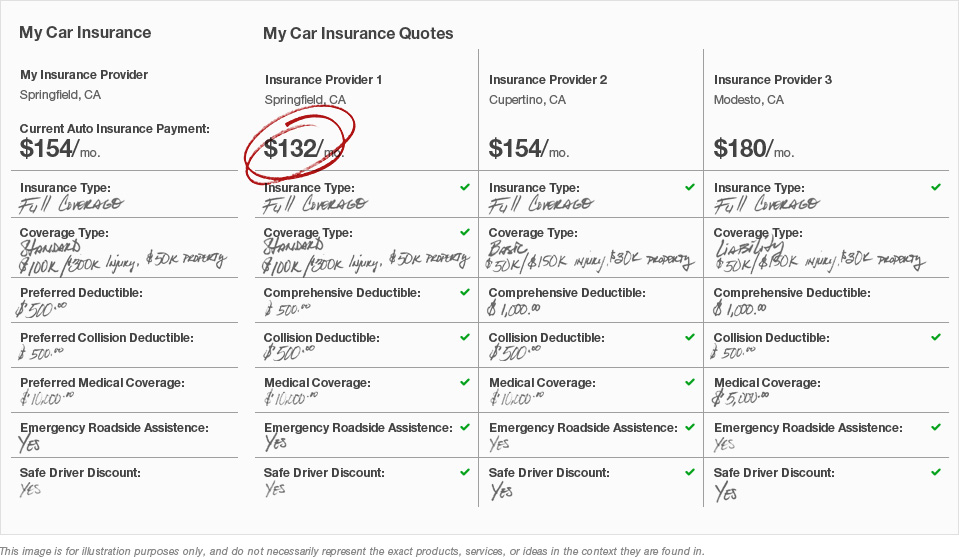

Comparison Example

Shopping for the right car insurance quote means more than just picking the lowest option. It's about finding a balance between cost and coverage. Conducting a thorough comparison can prevent substantial losses in the event of an accident.

Tips for Getting Accurate Quotes

To ensure you receive accurate quotes, provide consistent information between insurers. Small discrepancies can lead to inflated premiums or inadequate coverage options. Getting estimates from multiple insurers is beneficial to find the most advantageous offers tailored to your specific needs.

Visual Representation

Often times, educational videos like the one above can clarify complex terms and policies associated with car insurance. Engaging with educational content can substantially improve your knowledge and help you navigate the insurance landscape more effectively.

Learning How to Compare Quotes

Understanding how to compare car insurance companies is key in finding the best plan. Look for coverage offerings, customer service ratings, and claims processing timelines. Not all insurers perform equally, so thorough research is necessary.

Recent Updates on Car Insurance

With evolving laws and regulations, staying updated on changes can impact the type of coverage available and the premiums you may pay. Reviewing updates annually can aid in ensuring you have the best coverage for your current situation.

Car insurance is not merely a legal obligation; it’s an investment in your financial future. Ensuring the correct policy fits your needs will secure peace of mind on the road. Always approach the process proactively, and use the resources available at your disposal.

1. What are the key components that drive the price of a car insurance quote?

The price of a car insurance quote is driven by several key components including the driver's history, type of vehicle, location of residence, and selected coverage options. Each of these factors can significantly impact the overall premium, making it essential for drivers to understand how each element contributes to their insurance costs.

2. How often should one compare car insurance quotes?

Drivers should compare car insurance quotes at least once a year or after any major life changes, such as relocating, getting married, or purchasing a new vehicle. Regular comparisons ensure that policyholders are aware of market changes and are not overpaying for coverage that no longer meets their needs.

3. What risks are involved in opting for the lowest car insurance quote?

Choosing the lowest car insurance quote can lead to considerable risks, such as insufficient coverage, lack of necessary policy features, and potentially inadequate customer service when claims arise. A low quote might come with high deductibles or exclusions that could significantly limit protection in the event of an accident, leaving a driver vulnerable.