Home Insurance Quotes Funny Home Insurance Quotes. Quotesgram

Home insurance quotes are an essential part of property ownership and financial planning. Understanding the various aspects of these quotes is crucial for homeowners looking to safeguard their investments. This article delves into the intricacies of home insurance quotes, exploring their significance, how they are generated, and key factors that influence their values.

Before diving deeper, it’s vital to underline the purpose of home insurance. This type of insurance provides financial protection against damages to a home, including damage caused by natural disasters, theft, and liability for injuries that may occur on the property. Here’s a breakdown of significant components related to home insurance quotes:

- Understanding Home Insurance Quotes:

- Home insurance quotes are estimates provided by insurance companies to determine the cost of insuring a home.

- These quotes take into account various factors including the home’s value, location, the homeowner’s claims history, and the coverage options selected.

- Factors Influencing Home Insurance Quotes:

- Property Location: Homes located in areas prone to natural disasters like floods or earthquakes may incur higher premiums.

- Home Characteristics: The age, size, and condition of the home can affect its insurability and the cost of insurance.

- Policy Coverage: The extent of coverage chosen by the homeowner directly impacts the premium; more comprehensive coverage typically leads to higher quotes.

- Deductibles: Higher deductibles can lower premium costs, but they also mean the homeowner pays more out-of-pocket during a claim.

- Comparing Quotes:

- Homeowners should obtain multiple quotes from different insurers to ensure they are getting the best rate.

- Comparing quotes not only involves looking at the price but also understanding the coverage details and exclusions.

- Importance of Reviews and Ratings:

- Researching customer reviews and the financial strength of the insurance company can provide insights into their reliability.

- Understanding the claims process and customer service reputation can help you make an informed choice.

- Regular Reevaluation:

- Homeowners should review their insurance policies annually to account for any changes in the property value or improvements made to the home.

- Adjusting coverage to reflect current home value can ensure optimal protection and cost savings.

How To Read A Homeowners Insurance Quote

Reading a homeowners insurance quote can be tricky. It is not just about the overall premium but understanding the fine print that informs you about what is covered and what is not. Key sections to pay attention to include:

- Coverage Types: Look for detailed breakdowns that specify dwelling coverage, personal property coverage, liability coverage, and additional living expenses.

- Premium and Deductibles: The total premium amount, including any discounts applied, and the deductible will be indicated clearly, impacting out-of-pocket expenses during a claim.

- Exclusions: Pay close attention to what is not covered in the policy to avoid surprises later on.

Geico Home Insurance Quote Lookup

Accessing home insurance quotes through Geico is an efficient way to gauge the financial requirements for insuring your home. Their online tools make it easy to input your details and receive an estimate quickly. Be sure to review the coverage options available and consider how they align with your needs.

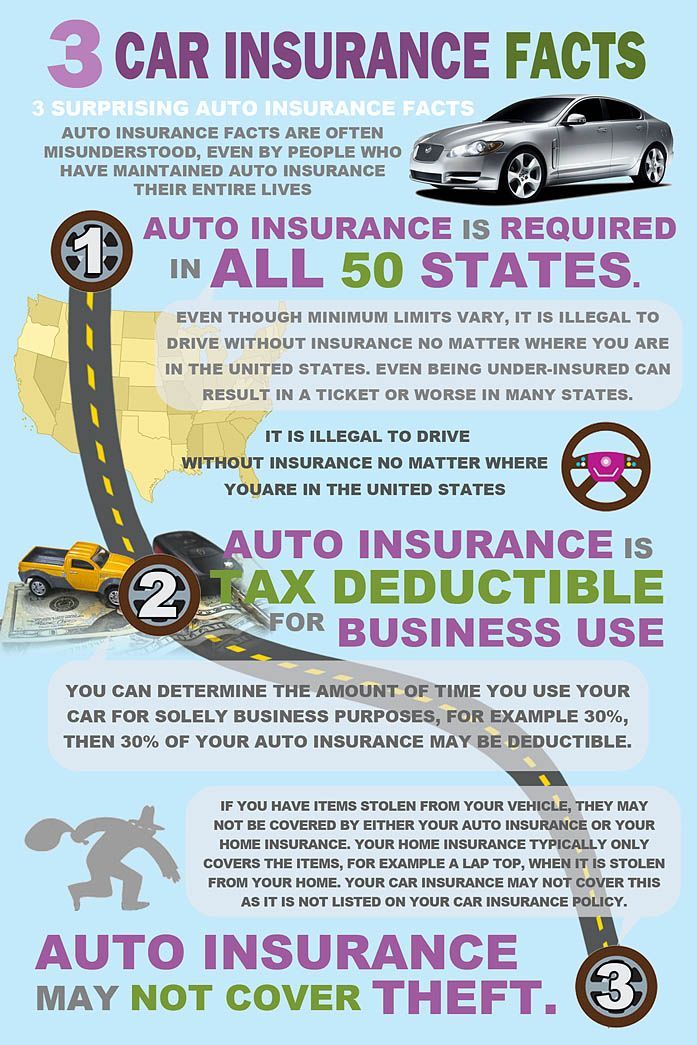

Home And Auto Insurance Quotes - ShortQuotes.cc

Bundling home and auto insurance is often advantageous. Many providers offer discounts for multiple policies which can significantly lower overall costs. When considering these bundled quotes, analyze both individual coverages and bundled discounts to see the best overall financial benefit.

Famous Home Insurance Quotes Ideas - ASURANSI TERBAIK

Home insurance quotes are metaphorically described through famous quotes that highlight the importance of preparation and securing one’s future. These literary expressions can inspire homeowners about the necessity of having comprehensive insurance coverage.

Homeowners Insurance Quotes Online - SERMUHAN

Finding home insurance quotes online is crucial in today’s tech-driven world. Online platforms facilitate easy access to quotes, comparison tools, and instant estimates. This method saves time and allows for a thorough exploration of policy options.

Comparing Home Insurance Quotes: A Comprehensive Guide - Modern House

To get the best home insurance deal, a comprehensive guide to comparing quotes is beneficial. Investigating not just price but also the level of service and the expertise of the insurer can yield extensive benefits in securing adequate home coverage.

1. What are the key factors that determine the cost of home insurance quotes?

The key factors determining the cost of home insurance quotes include property location, home characteristics (age, size, and condition), the extent and type of coverage selected, deductible amounts, and the homeowner's claims history. Each of these attributes plays a significant role in how insurers assess risk and ultimately set the premium for coverage.

2. How can homeowners lower their home insurance quotes effectively?

Homeowners can effectively lower their insurance quotes by increasing their deductibles, shopping around for competitive quotes, bundling insurance policies, maintaining a good credit history, and implementing safety features like security systems. Each of these strategies can contribute to lower premiums, making insurance more affordable.

3. What are common misconceptions about home insurance quotes?

Common misconceptions about home insurance quotes include the belief that the cheapest quote is always the best option, assuming all policies cover the same risks, and thinking that older homes cannot get competitive insurance rates. These misconceptions can lead homeowners to inadequate coverage or increased risk, underscoring the importance of thorough comparisons and understanding policy details.