Car Insurance Comparison 13 Ways To Save On Car Insurance

Car insurance is an essential aspect of vehicle ownership that protects drivers from financial loss due to accidents, theft, or other unforeseen events. Given the variety of options available in the market, comparing car insurance policies is crucial for consumers seeking the best coverage at the most competitive rates. This article delves into the importance of car insurance comparison, the factors to consider, and the benefits of utilizing comparison tools.

Understanding car insurance comparison begins with recognizing the types of coverage available:

- Liability Coverage: This is mandatory in most states and covers damages to other people and their property in case you are at fault in an accident.

- Comprehensive Coverage: This type covers damages to your vehicle not involving a collision, such as theft, vandalism, or natural disasters.

- Collision Coverage: This covers damages to your vehicle caused by a collision with another vehicle or object.

- Personal Injury Protection (PIP): This provides coverage for medical expenses and, in some cases, lost wages, regardless of who is at fault.

- Uninsured/Underinsured Motorist Protection: This is essential for accidents involving drivers who lack adequate insurance coverage.

Best Car Insurance Comparison Sites

Various online platforms allow users to compare car insurance rates effectively:

- Compare.com: This site provides users with several quotes based on their input, making it easier to find the lowest rates.

- CarInsuranceRates.com: With a focus on state-specific rates, this platform allows users to see the best options available in their area.

- Insurance Company Comparison Charts: Websites offering visual charts aid in simplifying complex information, allowing users to make more informed decisions.

Why Compare Car Insurance?

Comparing car insurance is beneficial for several reasons:

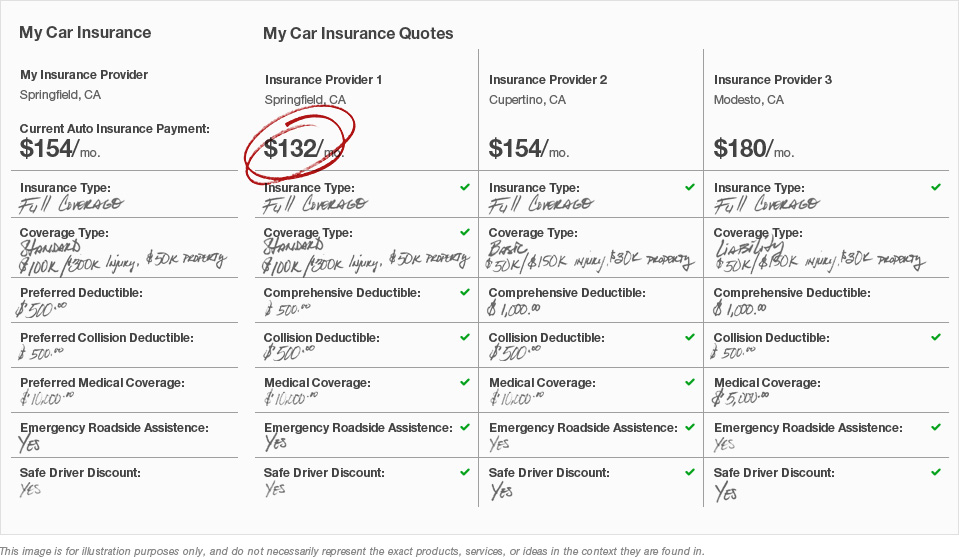

- Cost Savings: By comparing quotes, drivers can find cheaper premiums without sacrificing coverage quality.

- Understanding Coverage Options: Different insurers offer various policies and discounts that can affect overall costs and coverage levels.

- Evaluating Claims Process: Researching customer reviews and ratings can give insight into the insurer's reliability in claims handling.

- Customizing Coverage: Comparing options helps users tailor their insurance to fit their unique needs, ensuring they get value for their money.

Factors to Consider When Comparing Car Insurance

When comparing car insurance policies, consider the following factors:

- Premiums: The amount paid regularly for the policy can vary significantly between providers.

- Coverage Limits: Ensure that the policy meets the minimum legal requirements and provides adequate protection for your assets.

- Deductibles: A higher deductible usually results in lower premiums; however, this means more out-of-pocket expenses in case of a claim.

- Discounts: Look for discounts offered by insurers for safe driving, multiple policies, or being a member of certain organizations.

- Financial Stability: Research the insurer's financial health to ensure that they can pay claims when required.

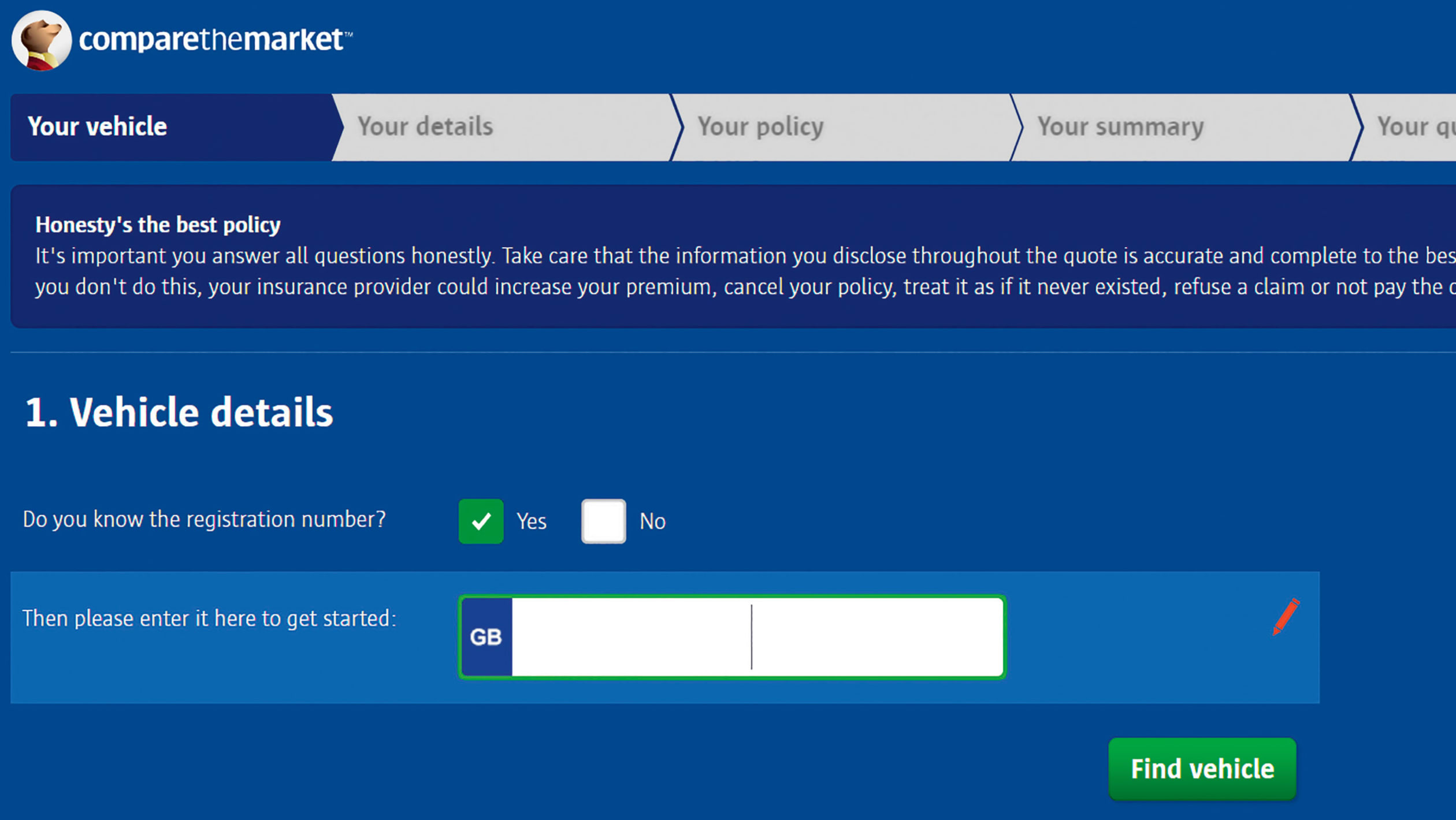

Using Comparison Tools Effectively

Comparison tools are designed to simplify the research process. To use them effectively:

- Input Accurate Information: Be honest about your driving history and vehicle details for the most accurate quotes.

- Compare Similar Coverage: Ensure that you are comparing policies with similar limits and deductibles.

- Read Reviews: Customer reviews can provide insight into the quality of service and claims experience.

Conclusion

In conclusion, comparing car insurance is a vital part of being a responsible vehicle owner. By understanding coverage types, utilizing comparison tools, and considering various factors, you can find the best car insurance policy tailored to your needs. The insights gained from this process can lead to significant cost savings and greater peace of mind on the road.

Question 1: How does car insurance comparison enhance the policy selection process?

Answer: Car insurance comparison enhances the policy selection process by allowing consumers to evaluate multiple insurance options simultaneously. Consumers can assess premiums, coverage types, and policy benefits, which helps in making a more informed decision. By considering various providers, individuals can identify the best fit for their specific needs while ensuring they do not overpay for coverage.

Question 2: What role do customer reviews play in selecting a car insurance policy?

Answer: Customer reviews play a significant role in selecting a car insurance policy by providing insights into other consumers’ experiences with the insurer. Positive reviews can indicate reliable customer service and efficient claims processing, while negative feedback may highlight potential issues. Evaluating reviews helps consumers gauge the overall reputation and quality of the insurer before making a commitment.

Question 3: What impact does state regulation have on car insurance comparison?

Answer: State regulation impacts car insurance comparison by establishing minimum coverage requirements and influencing premium rates across different regions. This variation in regulations means that policies must comply with local laws, affecting the options available for comparison. Consumers must consider these regulations when selecting an insurance policy, as they can influence both costs and coverage levels significantly.