Compare Auto Insurance Insurance Car Comparison Quotes Shopping Auto Compare Stop Online Shop Pull Incredibly Easy These

Comparing auto insurance is a critical step in ensuring you get the best possible coverage at the most competitive rates. With countless providers and policy options available, the task can feel overwhelming, but understanding what factors to consider will make your search much more manageable. Below, we’ll explore key elements of comparing auto insurance, why it matters, and how to make informed decisions.

When it comes to auto insurance, it’s not just about finding the lowest price; it’s about finding the best value for your money. Here are several aspects to keep in mind:

- Coverage Options: Different insurance companies offer varying types of coverage. Standard include:

- Liability Coverage: This covers bodily injury and property damage to others if you’re at fault in an accident.

- Collision Coverage: This pays for damage to your vehicle resulting from a collision.

- Comprehensive Coverage: This covers damages to your car not involving a collision, like theft, vandalism, or natural disasters.

- Personal Injury Protection: This can help cover medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Protection: This protects you in case you're in an accident with a driver who has insufficient or no insurance.

- Pricing: Prices can differ drastically between providers. When comparing quotes:

- Look at the total premium, deductible, and out-of-pocket costs.

- Ask if discounts are available for safe driving records or multi-policy coverage.

- Don’t overlook the fine print; many policies have hidden fees or exceptional circumstances that can significantly raise costs.

- Customer Service and Claims Handling: The quality of service you receive can greatly impact your experience. Consider looking for:

- Ratings and reviews from customers about their experiences with filing claims.

- The ease of access to customer support representatives when you need assistance.

- Average claim settlement times and whether customers report satisfaction with the outcomes.

- Financial Stability: An insurance company’s financial health plays a crucial role. You want a provider who can pay claims without issues. Look for:

- Ratings from independent financial ratings agencies.

- History of stability and integrity in payouts and business practices.

- Policy Customization: The ability to tailor your policy to fit your needs is essential. Be sure to check:

- Options for additional riders or endorsements.

- Flexible payment plans that suit your financial situation.

By following these considerations, you’ll be better equipped to find auto insurance that meets your needs without breaking the bank. Always take the time to compare multiple quotes and thoroughly understand your coverage before making any commitments.

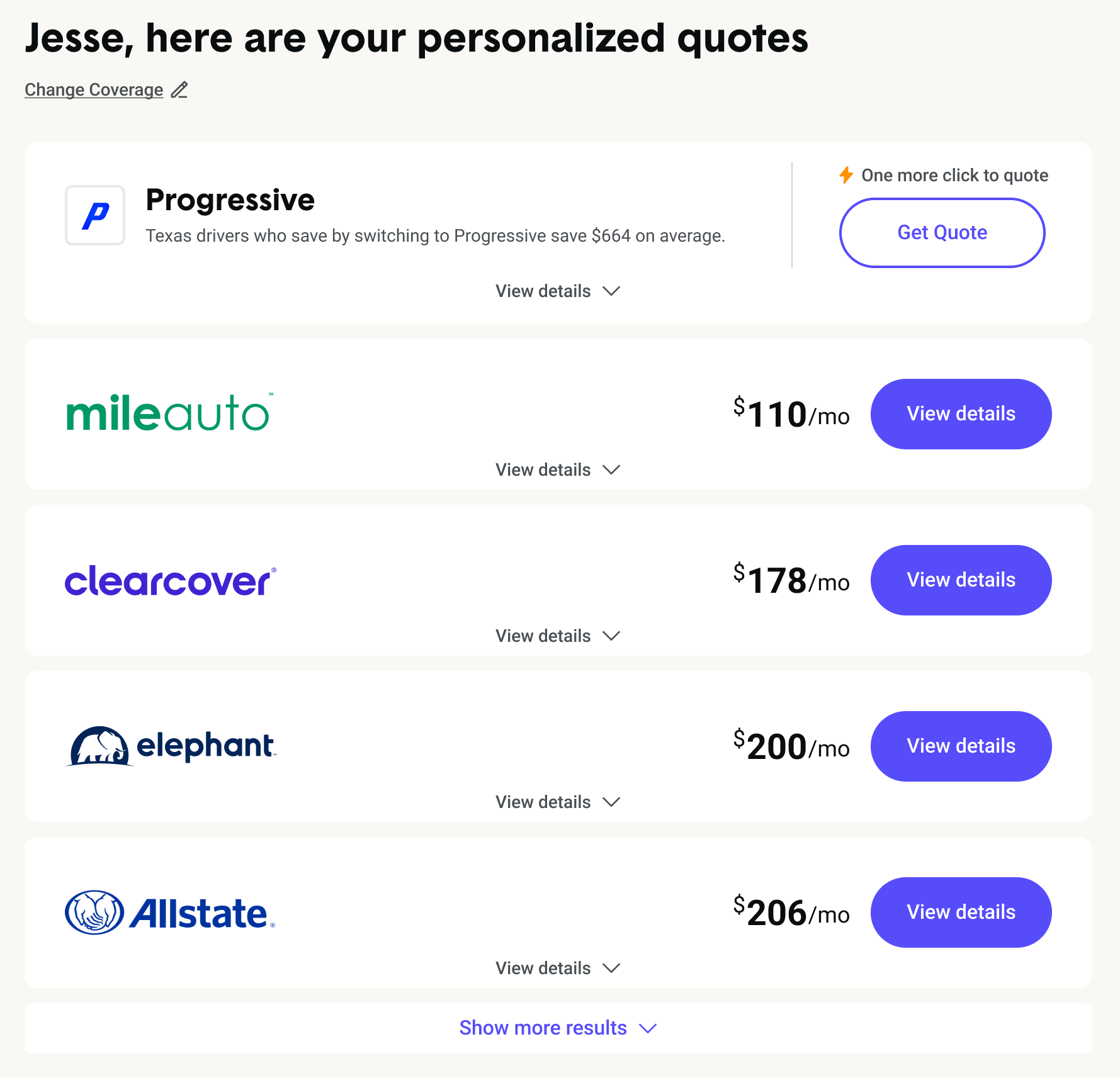

Visual tools can help encapsulate the differences in coverage and costs across multiple providers, making it easier to analyze which policy is right for you.

Consider these seven strategies when evaluating your options, as they will optimize your search for the most competitive insurance coverage.

Side-by-side comparisons are essential for ensuring that you have a complete understanding of what each option offers. This visual representation can help clarify the distinctions and make the decision-making process smoother.

The benefits of comparing auto insurance cannot be overstated. By understanding why thorough comparison is vital, you can approach your selection process with confidence.

Even specific markets, such as Florida, have unique factors to consider, highlighting the necessity of local insight when comparing insurance providers.

International comparisons, such as those for Canadian auto insurance, can shed light on global best practices and diverse coverage standards, enriching your understanding of this crucial area.

1. What are the key advantages of comparing auto insurance quotes from different providers?

Comparing auto insurance quotes from different providers allows individuals to identify which policies offer the best value for their specific needs. When quoting, consumers can assess the range of coverage, premium rates, customer service quality, and claim handling efficiency. This thorough analysis leads to informed purchasing decisions while maximizing financial benefits and ensuring adequate protection.

2. How does the type of coverage affect the overall cost of auto insurance?

The type of coverage significantly impacts the overall cost of auto insurance. Comprehensive coverage generally has a higher premium compared to basic liability coverage due to the broader range of risks it covers. Moreover, optional coverages like roadside assistance or rental reimbursement can further elevate costs. Therefore, understanding coverage types helps consumers balance necessary protection and affordability within their auto insurance expenses.

3. Why is financial stability important when selecting an auto insurance provider?

Financial stability is crucial when selecting an auto insurance provider because it directly influences the insurer’s ability to pay claims. A financially robust company is less likely to face bankruptcy issues or become unable to fulfill its obligations during economic downturns. Ensuring that the chosen provider has solid financial ratings and a history of honoring claims is essential for securing reliable and long-term coverage.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/6ZSXS37WCJABPPHK7A5HJAQBAY)