Auto Insurance Rates Insurance Average Car Per Cloudfront Month Cost Much Source Rates

Auto insurance rates are an essential aspect of car ownership that every driver must navigate. The costs associated with auto insurance can vary significantly based on a variety of factors. Understanding these factors is crucial for drivers looking to manage their expenses effectively while ensuring they are adequately covered in case of accidents or damages. In this article, we delve deep into the factors influencing auto insurance rates, current trends, and practical tips for drivers to potentially lower their insurance costs.

Factors Influencing Auto Insurance Rates

- Demographic Factors: Age, gender, and marital status can significantly affect insurance rates. For instance, young drivers, particularly males, often face higher premiums due to statistical data indicating they are more likely to be involved in accidents.

- Driving History: A driver’s record plays a vital role. Drivers with clean records typically enjoy lower rates, while those with accidents, citations, or any traffic violations may see their premiums increase.

- Location: Where you live directly impacts your insurance rates. Urban areas typically have higher rates due to increased traffic, higher rates of accidents, and thefts compared to rural areas.

- Type of Vehicle: The make and model of your vehicle also matter. Sports cars or vehicles known for high speeds may incur higher premiums than sedans or family cars. Additionally, if a car is rated poorly on safety tests, this will also affect insurance costs.

- Credit Score: Many insurance companies use credit scores as a factor in determining rates. Better credit typically results in lower premiums, as it is often correlated with lower risk.

- Coverage Level: The level of coverage you choose (liability, comprehensive, collision, etc.) will directly influence your premium. Opting for minimal coverage will lower the cost, but may leave the driver underinsured.

- Claims History: Previous claims can influence future insurance costs; repeat claims may label someone as 'high-risk' leading to increased premiums.

- Discounts: Many insurance companies offer discounts for various reasons like bundling insurance policies, maintaining good grades (for students), or taking defensive driving courses.

Current Trends in Auto Insurance Rates

As we move through 2024, trends show consistent increases in auto insurance rates across the United States, with premiums rising sharply in recent years. Here are some notable trends:

- Rising Costs: Statistics indicate that car insurance costs have soared by 44% since 2021, reflecting the rising expenses associated with claims and repairs.

- Age and Insurance Rates: Younger drivers continue to face high premiums, but an emerging trend suggests that older drivers (aged 65 and above) are also seeing increases due to aging and related health concerns.

- Impact of Technology: Telematics—devices that monitor driving patterns—are becoming more prevalent. Drivers who demonstrate safe driving habits can receive lower premiums, prompting more people to adopt safe driving practices.

- Legislative Changes: Changes in state laws can also affect premiums significantly. Some states have modified insurance requirements, leading to variations in costs.

Tips for Lowering Auto Insurance Rates

If you’re looking to reduce your auto insurance costs, here are several tactics to consider:

- Shop Around: Don’t settle for the first quote you receive. Compare rates from multiple insurance companies to find the most favorable offer.

- Increase Deductibles: Consider raising your deductibles. A higher deductible usually leads to a lower premium, but make sure it’s an amount you can afford in case of a claim.

- Bundle Policies: If you have multiple insurance needs, such as home or renters insurance, bundling them with the same provider can often yield discounts.

- Maintain a Good Credit Score: Work on improving your credit score; better credit often translates to lower premiums.

- Take Advantage of Discounts: Inquire with your insurer about available discounts for safe driving, defensive driving courses, or affiliations with specific organizations.

- Review Coverage Needs: Regularly review your coverage requirements and adjust them according to your circumstances. For example, if you’ve paid off your car, you might not need full coverage.

Understanding Auto Insurance Rates

Auto insurance rates can be complicated, and many people may find it challenging to understand why they pay what they do. The variability can often be confusing, but digging into the core components can provide clarity.

Question Exploration

What are the primary factors that determine auto insurance rates?

The primary factors determining auto insurance rates include demographic elements like age and gender, driving history which encompasses past accidents and violations, and geographical considerations such as urban or rural residency. Additionally, the type of vehicle and its safety rating significantly influence rates. Other essential aspects are credit scores, previous claims history, and the chosen level of coverage. Discounts for safe driving, bundling policies, and maintaining a good credit score can also help lower premiums.

Why do auto insurance rates vary significantly between different states?

Auto insurance rates vary significantly between states due to differences in state regulations, laws governing insurance, driving behaviors, and environmental factors. For instance, states with higher traffic densities or accident rates often have higher premiums. Moreover, the prevalence of uninsured motorists can also increase rates. Local economic conditions, including repair costs and legal fees, play a critical role as well in establishing the regulatory environment that dictates how much drivers pay for coverage.

How can a driver assess whether they are getting a competitive rate for their auto insurance?

A driver can assess if they are getting a competitive rate for auto insurance by comparing quotes from several insurance companies, reading reviews, and evaluating the coverage offered relative to the premiums charged. It’s beneficial to look at industry averages for comparable coverage levels within their geographical area. Engaging with an independent insurance agent who has access to numerous providers may also provide insights into competitive pricing and policies tailored to individual needs.

In conclusion, navigating the complexities of auto insurance rates requires understanding the numerous influencing factors, keeping abreast of current trends, and employing strategies to save on premiums. With this knowledge, drivers can make informed decisions that not only save them money but also ensure they have adequate coverage on the road.

Visual Reference

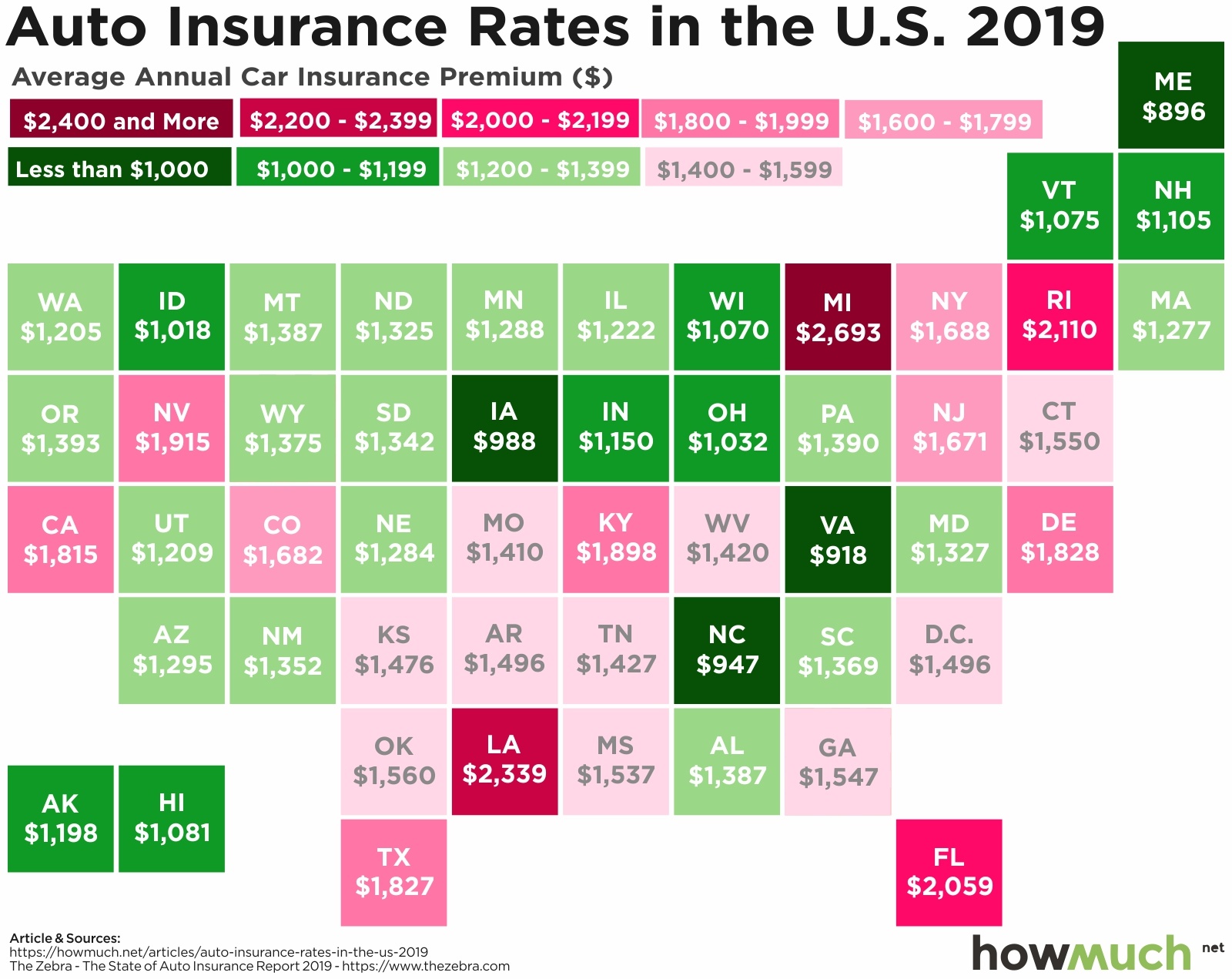

Car Insurance Rates By State 2018

This image illustrates the variations in car insurance rates across different states in the year 2018, underscoring how location impacts auto insurance costs.

Car Insurance Industry Statistics in 2024 | The Zebra

The statistic showcases the average 6-month car insurance rates segmented by age group for 2024, highlighting how age influences pricing.

Cheapest New Cars To Insure For Teenagers

This chart displays the cheapest new cars for teenagers to insure, demonstrating the connection between vehicle choice and insurance costs.

Car Insurance Costs By State 2021

The image represents car insurance costs by state in 2021, showing how premiums have escalated in recent times and the geographical disparities in insurance rates.