Automotive Insurance Quote Auto Insurance Quotes

Automotive insurance quotes are a crucial aspect of car ownership, as they provide valuable insights into the costs associated with insuring a vehicle. In a world where accidents and damages can occur at any time, having appropriate coverage is essential to protect both yourself and your investment. This article delves into the nuances of automotive insurance quotes, the factors affecting them, and how to secure the best options available.

When seeking an automotive insurance quote, it’s essential to understand the different elements that contribute to the final price. Here are some critical aspects to consider:

- Type of Coverage: Automotive insurance typically includes several types of coverage, such as liability, collision, comprehensive, and personal injury protection. Each type varies in cost and relevance to the insured participants.

- Vehicle Make and Model: The cost to insure a vehicle largely depends on its make, model, and year. High-end or sporty models often attract higher premiums compared to more common, economically driven vehicles.

- Driver's Age and Experience: Generally, younger drivers or those with less driving experience tend to face higher insurance rates due to their perceived higher risk.

- Driving History: A clean driving record with minimal claims can significantly reduce the cost of insurance, while a history of accidents or violations may lead to increased premiums.

- Location: Where you live can also play a role in your insurance quote. Areas with higher crime rates or more traffic accidents typically have higher insurance costs.

- Credit Score: Insurers may use credit scores as a factor in determining premiums. A higher credit score can lead to lower rates.

In addition to understanding these factors, it's vital to know the methods of obtaining automotive insurance quotes. Here are a few common approaches:

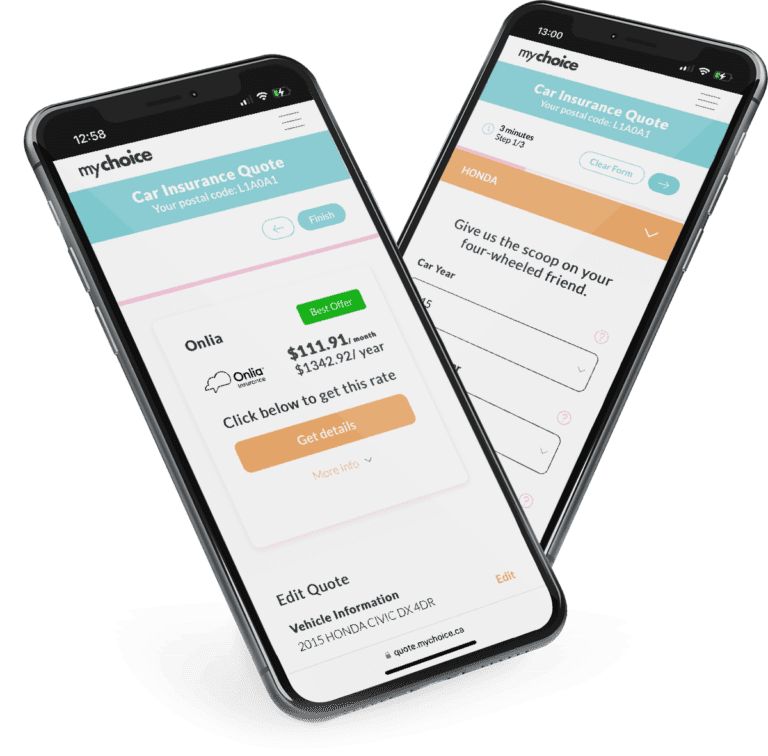

- Online Comparison Tools: Utilizing various online platforms allows potential policyholders to compare quotes from numerous insurance companies effortlessly.

- Direct Insurance Company Websites: Many insurance providers allow you to get a quote directly through their websites, providing a straightforward approach to understanding your insurance options.

- Insurance Agents: Consulting with an insurance agent can also provide personalized insights and quotes tailored to your specific needs.

Once you’ve gathered multiple quotes, it's important to evaluate them carefully. Look beyond the premium amounts and consider the coverage terms, exclusions, deductibles, and customer service ratings. A cheaper policy might not always be the best choice if it lacks adequate coverage or has poor support. To help further illustrate this point, consider the following question:

What factors should be considered when comparing automotive insurance quotes?

When comparing automotive insurance quotes, you should consider:

- Coverage Limits: Review the limits of each coverage type offered in the policy, ensuring they meet your needs.

- Deductibles: Understand the deductible amounts you will be responsible for in the event of a claim.

- Discounts Available: Look for discounts for safe driving, bundling policies, or being a member of certain organizations.

- Company Reputation: Consider the insurance company’s financial stability and customer service reviews.

Obtaining multiple automotive insurance quotes and comparing them thoroughly will help you find the most suitable policy for your needs. By weighing all these factors, drivers can ensure they are not only getting a great price but also adequate protection on the road.

In today’s digital world, online platforms have made it easier than ever to gather automotive insurance quotes. However, it's crucial to approach your search strategically. Leverage technology, but don't hesitate to reach out to experts for clarification or advice. Balancing online tools with professional guidance can often yield the best results.

Moreover, many people overlook the importance of reviewing their policies regularly. As life changes—whether through relocations, vehicles changes, or improved driving records—modifying your automotive insurance is essential. Regular reviews can lead to diminished premiums and better coverage tailored to your evolving needs.

Understanding the market landscape is also important when considering automotive insurance. The largest insurance companies typically have more comprehensive resources and may provide better coverage options, but they may not always offer the lowest premiums. Explore a mix of large insurers and smaller, specialized companies to find the best fit for your circumstances.

Ultimately, finding the right automotive insurance quote boils down to diligence and attention to detail. Individual circumstances vary widely, so no single policy exists that is perfect for every driver. A proactive approach, researching options, and reassessing regularly will lead to informed decision-making and peace of mind on the road.

Additionally, some questions that can deepen your understanding of automotive insurance quotes include:

How does driving behavior influence automotive insurance premiums?

Driving behavior directly influences automotive insurance premiums by assessing the risk associated with different driving habits. Insurers evaluate a driver's history, including accidents, speed violations, and overall driving frequency, to determine likelihood of future claims. Drivers with a record of safe, responsible driving may receive lower premiums as they represent a lower risk compared to those with a history of frequent traffic violations or accidents.

What role do credit scores play in determining automotive insurance quotes?

Credit scores play a substantial role in determining automotive insurance quotes as insurers assess financial responsibility as an indicator of a driver's risk profile. Individuals with higher credit scores generally receive more favorable quotes due to perceived reliability, while those with lower scores may be considered higher risk, resulting in elevated premiums. This practice stems from statistical correlations between credit history and the likelihood of filing insurance claims.

How often should an individual review their automotive insurance policy?

Individuals should review their automotive insurance policy at least annually to ensure coverage aligns with their current needs and financial situation. Regular reviews are crucial after life events such as moving, changing vehicles, or significant alterations in driving habits. This proactive approach helps policyholders identify potential savings, necessary adjustments, and optimal coverage to suit their evolving circumstances.

In conclusion, navigating the world of automotive insurance quotes requires a blend of knowledge, strategy, and careful evaluation. By understanding the different components that influence quotes, utilizing various tools, and keeping open communication with insurance professionals, drivers can make informed choices that fit both their budget and their safeguarding needs. Regular reviews and understanding of the insurance landscape will empower drivers to protect themselves adequately while optimizing their financial responsibilities. The road ahead becomes much clearer with the right insurance policy in place.