Cheap Liability Insurance The Average Cost Of Car Insurance In California: What You Need To Know

Cheap liability insurance is an essential aspect of protecting both individuals and businesses from potential legal claims. As unforeseen incidents can result in significant financial loss, having adequate liability coverage can safeguard against the costs associated with legal fees, settlements, and other related expenses. This article delves into various aspects of cheap liability insurance, including its importance, types, factors that affect costs, and how to find the best policies.

One of the primary motivations for seeking cheap liability insurance is the potential for customer or client claims. Whether you are a small business owner or a self-employed individual, liability insurance is designed to cover claims for injuries, damages, or losses that occur as a result of your operations. Here are some critical points to consider:

- Importance of Liability Insurance:

- Legal Protection: Liability insurance covers legal fees and costs associated with defense and settlements.

- Peace of Mind: Knowing you have coverage can reduce stress related to potential lawsuits.

- Enhances Credibility: Having liability insurance can improve your professional image and attract clients.

Understanding Different Types of Liability Insurance

Liability insurance comes in various forms, each catering to specific needs:

- General Liability Insurance: Protects businesses from claims related to bodily injury, property damage, and personal injury.

- Professional Liability Insurance: Also known as errors and omissions insurance, this protects professionals against claims of negligence or inadequate work.

- Product Liability Insurance: Covers manufacturers and retailers against claims related to product defects that cause injuries or damages.

- Employer’s Liability Insurance: Protects businesses against claims made by employees for work-related injuries or illnesses.

Factors Affecting the Cost of Cheap Liability Insurance

Understanding the factors that influence liability insurance premiums can help you find cheaper options:

- Business Type: Some industries have higher risks, resulting in higher premiums.

- Coverage Amount: The higher the coverage limit, the higher the premium will generally be.

- Claims History: A history of previous claims can lead to higher premiums.

- Location: Certain locations may have higher rates of litigation or claims, affecting costs.

How to Find Cheap Liability Insurance

Finding affordable liability insurance involves several steps:

- Shop Around: Utilize online comparison tools to evaluate quotes from multiple providers.

- Consult an Insurance Agent: Seek professional advice to tailor your coverage to your specific needs.

- Review Policy Details: Read the fine print and understand your coverage limits and exclusions.

- Bundle Policies: Consider bundling liability insurance with other insurance policies for potential discounts.

Having established an understanding of cheap liability insurance, let’s explore an important question that can help clarify this topic:

1. What are the primary factors to consider when choosing cheap liability insurance?

When choosing cheap liability insurance, consider the relevant factors including your industry’s risk profile, the coverage amounts required for your unique circumstances, your previous claims history, and localized legal conditions that may affect the likelihood of claims. By assessing these factors, you can identify an insurance policy that offers sufficient protection at a price point that fits your budget.

2. How can an individual or business determine the right amount of coverage for cheap liability insurance?

To determine the right amount of coverage for cheap liability insurance, individuals or businesses should evaluate potential risks associated with their activities, assess historical data on claims in their industry, and consider legal requirements for liability insurance in their jurisdiction. Additionally, consulting with an insurance professional can help tailor the amount of coverage to adequately protect against significant financial consequences while remaining affordable.

3. What role does an insurance broker play in securing cheap liability insurance?

An insurance broker acts as an intermediary between clients and insurance companies, helping individuals and businesses navigate the complexities of selecting cheap liability insurance. Their role includes assessing the client's needs, providing expert advice on policy options, comparing prices from various providers, and negotiating terms to ensure comprehensive coverage at the most competitive rates.

In summary, cheap liability insurance is an important aspect of financial protection for individuals and businesses. By understanding the different types, factors affecting costs, and how to find the best policies, one can strike a balance between adequate coverage and affordability. Furthermore, addressing key questions about the selection process, proper coverage amounts, and the broker’s role can significantly enhance informed decision-making when choosing liability insurance.

Visual References

Average Cost Of Small Business Liability Insurance

This image illustrates the average costs linked to small business liability insurance, highlighting the financial considerations for business owners.

Cheap Liability Insurance: All You Need to Know in 2023

This image encapsulates essential information about cheap liability insurance and serves as a comprehensive guide for 2023.

All You Need to Know About Cheap Liability Insurance

This visual resource presents a video summarizing the key aspects of cheap liability insurance, perfect for visual learners.

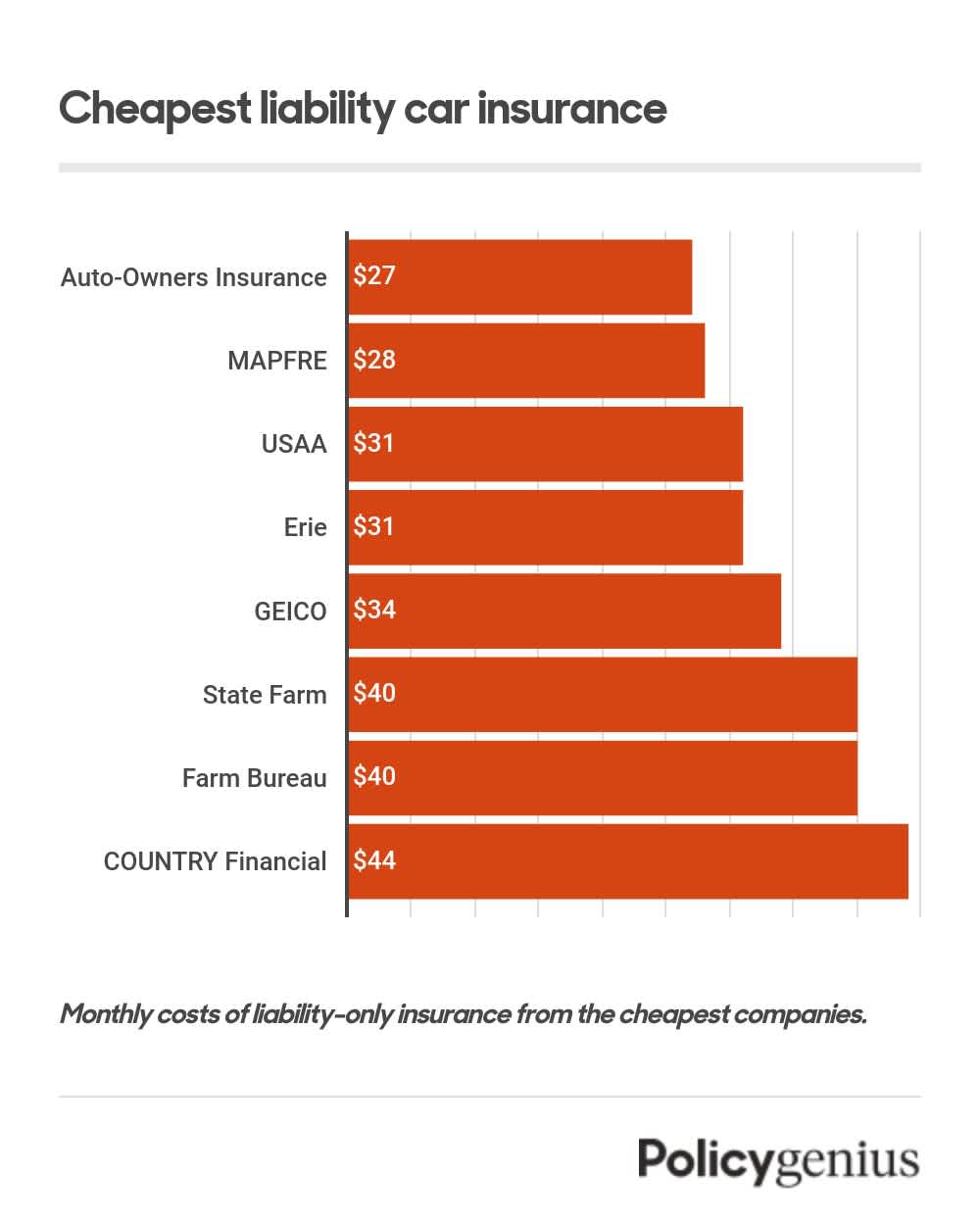

Cheapest Liability-Only Car Insurance (2024)

This image focuses on the cheapest options available for liability-only car insurance, beneficial for drivers looking to minimize costs.

Average Cost Of Car Insurance 2022

This image showcases the average costs associated with car insurance, providing insight into liability coverage for motorists.

How to Reduce Employers' Liability Insurance

This visual represents various strategies for businesses to mitigate costs associated with employers' liability insurance.