Insurance Car Cheap Best Cheap Car Insurance Company In The World

Insurance is a critical aspect of car ownership, serving as a financial safety net for drivers against unforeseen events such as accidents, theft, or damage. With the rising costs of living, many individuals are in search of affordable insurance policies that do not compromise on coverage. This has led to an increase in the demand for cheap car insurance options that cater to a range of budgets while providing adequate protection.

Finding cheap car insurance can seem daunting, but understanding various aspects of car insurance can make the process easier. Below are several crucial points you should consider when searching for budget-friendly insurance:

- Compare Quotes: One of the most effective ways to find cheap car insurance is to compare quotes from different insurance providers. Each company sets its rates based on various factors like age, driving history, and the type of vehicle. Websites that aggregate insurance quotes can help expedite this process.

- Consider Coverage Options: It's essential to understand the different types of coverage available. While the minimum state-required liability insurance may be the cheapest option, it might not provide adequate coverage in case of an accident. Comprehensive and collision coverage can offer better protection but at higher costs.

- Utilize Discounts: Many insurance companies offer discounts that can significantly reduce premiums. These can include discounts for safe driving, bundling policies (e.g., home and auto), and even for being a member of certain organizations or professions.

- Choose the Right Vehicle: The make and model of your car can impact your insurance premium. Typically, cars that are more expensive to repair or have higher theft rates will carry higher premiums. Opting for vehicles known for safety and reliability may lead to lower rates.

- Adjust Your Deductible: Increasing your deductible—the amount you pay before your insurance kicks in—can lead to lower monthly payments. However, be sure you can afford to pay the deductible in case of an accident.

- Maintain a Clean Driving Record: A history free of accidents and traffic violations reflects on your insurance costs. Insurers reward safe drivers with lower rates, making it beneficial to drive carefully.

- Reevaluate Your Policy Regularly: Life changes, and so do insurance needs. Periodically reviewing your policy can help you find better deals or adjust coverage as necessary.

By considering these factors while searching for cheap car insurance, you can identify the best options that provide coverage within your budget.

The Volkswagen Polo is an excellent example of a vehicle that balances affordability and reliability, making it an ideal choice for many drivers looking to maintain lower insurance premiums.

Learning smart strategies for obtaining car insurance can save money and provide peace of mind. The smart ways often include understanding your coverage needs and actively seeking out discounts.

Young adults may face higher insurance rates due to inexperience. However, there are tailored policies that cater specifically to this demographic, often focusing on educational resources to encourage safe driving habits.

The Hyundai i10 is one of the top-rated cars for cheap insurance in 2024, combining low running costs with a robust safety record.

Selecting the right insurance company is crucial. The best companies often provide competitive rates, excellent customer service, and comprehensive support for claims processes.

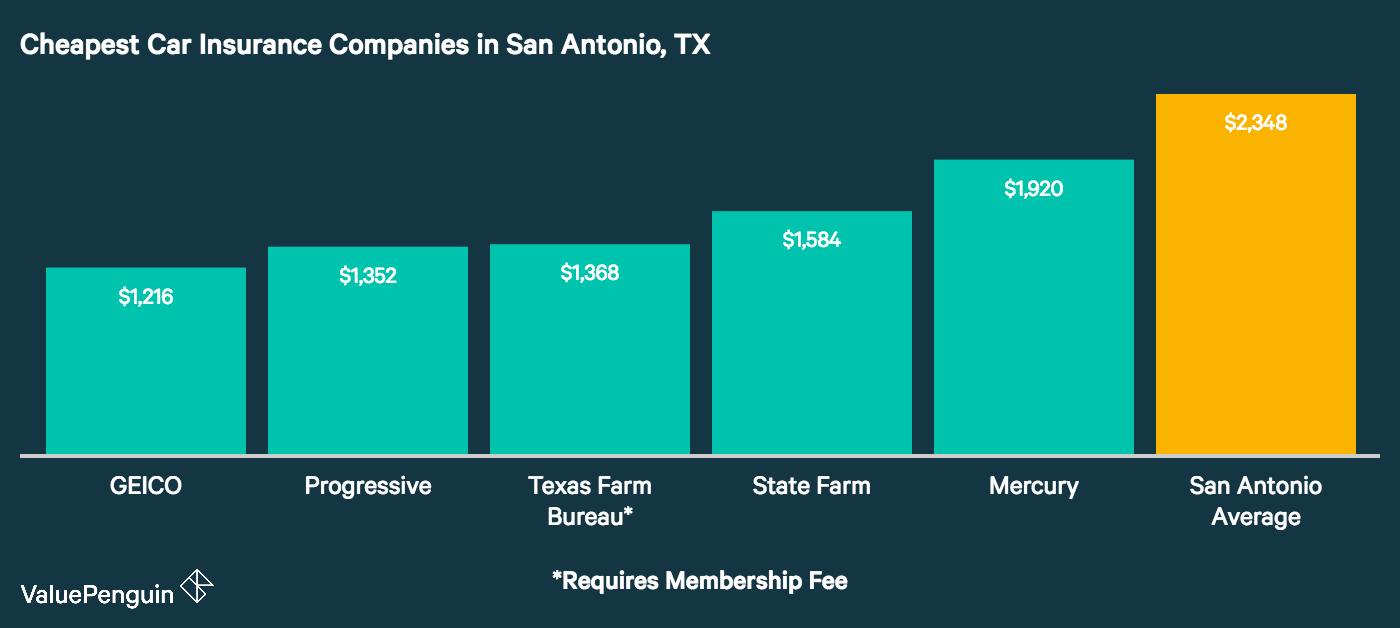

Regional characteristics can impact insurance rates significantly. Understanding who offers the cheapest quotes in your area, like Texas, empowers drivers to make informed decisions.

At this point, it's essential to explore the concept of cheap car insurance in-depth.

1. What are the main factors contributing to affordable car insurance rates?

Affordable car insurance rates are mainly influenced by the driver's history, the type of car insured, location, driving experience, and overall car safety ratings. Insurers assess these factors when calculating premiums to determine risk levels, aligning coverage costs with the driver's profile.

2. How can policyholders effectively lower their car insurance costs?

Policyholders can effectively lower car insurance costs by regularly comparing quotes, adjusting coverage levels, taking advantage of discounts, and maintaining a clean driving record. Each of these strategies plays a significant role in determining monthly premiums.

3. What role does the type of vehicle play in determining insurance costs?

The type of vehicle significantly affects insurance costs, as vehicles that are more expensive to repair, have higher theft rates, or possess higher horsepower typically incur higher premiums. Insurers consider these features when assessing risk and pricing policies.

In conclusion, finding affordable car insurance is a multifaceted task that requires careful consideration of various factors. By actively engaging with the market and understanding how coverage works, drivers can secure suitable insurance at a price that fits their budgets.