Shop Car Insurance Shopping For Car Insurance: What's Holding You Back?

Buying car insurance can often feel overwhelming, due to the vast number of options available and the intricacies of different policies. However, understanding how to shop for car insurance effectively can save you time and money. In this article, we will explore various strategies for comparing and selecting the best car insurance for your personal needs.

Understanding Car Insurance Types

The first step towards shopping for car insurance is to understand the different types of coverage available. Here's a breakdown:

- Liability Coverage: This is mandatory in most states and covers damages to others if you are at fault in an accident.

- Collision Coverage: This covers damages to your car resulting from a collision, regardless of fault.

- Comprehensive Coverage: This protects against non-collision-related incidents, such as theft or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This is essential for covering damages and medical expenses if you're in an accident with a driver who lacks sufficient insurance.

Researching Insurance Providers

Once you understand the coverages you need, it's time to research insurance providers. Consider the following:

- Read reviews from existing customers to gauge satisfaction levels.

- Check the financial stability of the insurers to ensure they can pay claims.

- Look for providers that have a good claim settlement ratio, as this reflects their reliability in processing claims.

- Consider local versus national providers; local agents may provide personalized service.

Comparing Quotes

After identifying potential insurance providers, the next major step is to compare quotes. Here are ways to do this effectively:

- Gather quotes from at least three to five insurers to have a diverse understanding of pricing.

- Ensure that you're comparing similar coverage levels – apples to apples, rather than apples to oranges.

- Pay attention to deductibles; a lower premium might mean a higher deductible, which could affect your pocket in the event of a claim.

- Ask about discounts offered for safe driving records, bundling policies, or being a member of certain organizations.

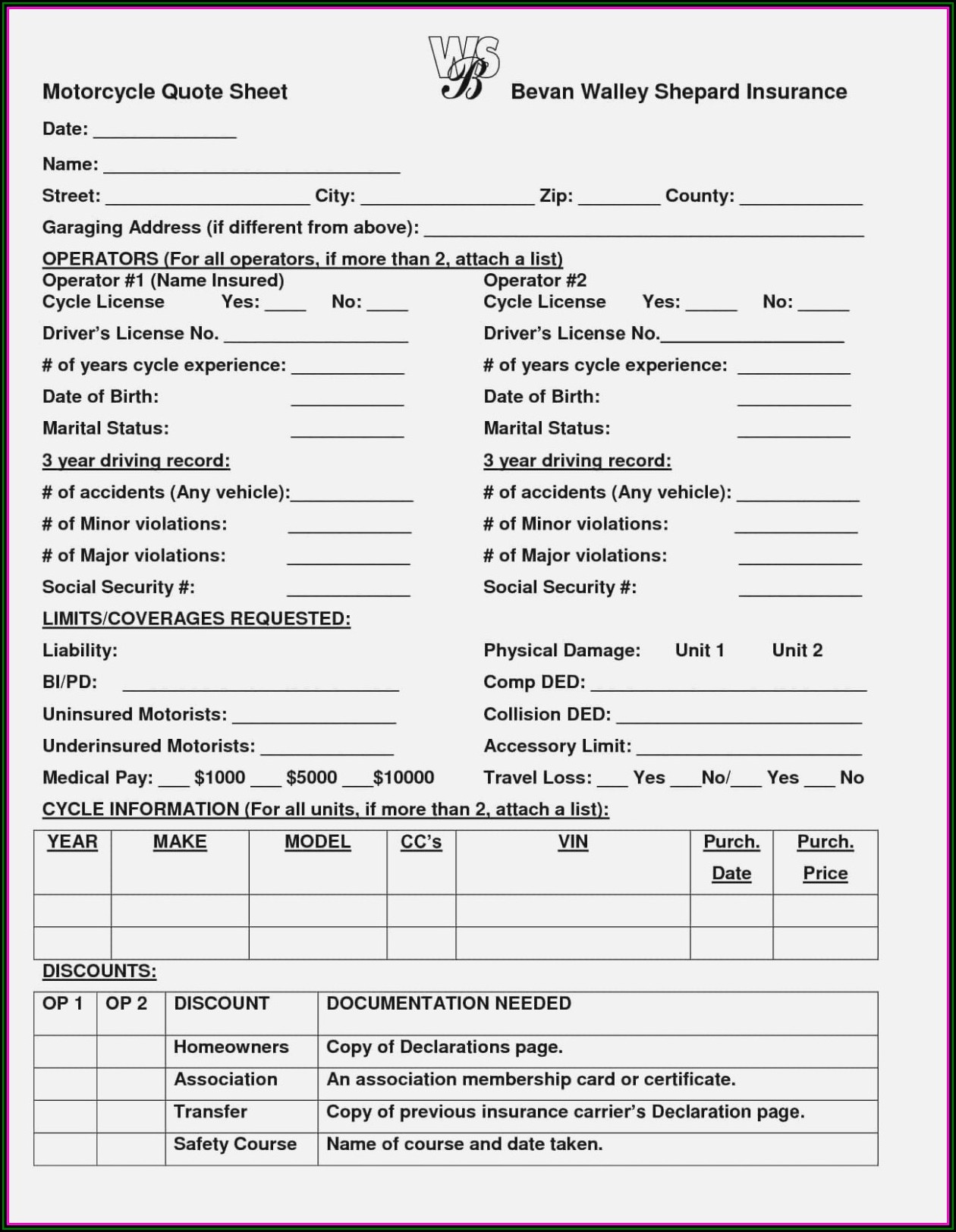

Evaluating Policy Features

![How to Shop for Car Insurance Quotes Online [Infographic]](https://infographicjournal.com/wp-content/uploads/2021/06/Shop-Car-Insurance-Quotes.jpg)

Before finalizing your decision, evaluate the features of each policy closely:

- Look for the policy's exclusions – knowing what's not covered is just as important as knowing what is.

- Understand the claims process, including how to file a claim and how claims are handled.

- Check the customer service availability – 24/7 support can be crucial during emergencies.

- Review potential add-ons, such as roadside assistance or rental car coverage, which might provide additional security.

Finalizing the Purchase

Once you’ve found the right policy, you will need to go through the purchase process. Here are the steps:

- Review the policy terms one last time before committing.

- Be prepared to provide personal information, including your driving record and vehicle details.

- Make any necessary upfront payments to activate your coverage.

- Ensure you receive a copy of your policy document and keep it in a safe place.

Maintaining Your Policy

Once you have purchased your car insurance, the work isn’t done. To get the most out of your coverage, consider the following:

- Regularly review your policy and shop around every couple of years to ensure you’re still receiving the best rates.

- Notify your insurer of any changes in your circumstances, such as moving or changes in driving habits.

- Take advantage of any discounts that you may qualify for as your situation changes, such as lowering your mileage or adding security devices to your vehicle.

- Keep a file of your insurance documents and correspondence for easy reference.

Now, let’s dive into some questions that can illuminate the process of shopping for car insurance.

Question 1: What should you consider when comparing different car insurance policies?

When comparing car insurance policies, consider factors such as coverage limits, deductibles, exclusions, premiums, and discounts. Ensure that you are looking at the same coverages across all policies to make a fair assessment. Additionally, research customer service ratings and claims handling processes, as these can significantly affect your experience should you need to file a claim.

Question 2: How can you ensure you get the best rates on car insurance?

To secure the best rates on car insurance, shop around by obtaining quotes from multiple providers, ideally at least three. Look for available discounts such as bundling insurance policies or having a clean driving record. Regularly review and update your coverage to reflect changes in your lifestyle or driving habits, and always maintain a good credit score, as many insurers consider this when determining your rates.

Question 3: What role does your driving record play in your car insurance premium?

Your driving record plays a crucial role in determining your car insurance premium. Insurance companies assess driving history to evaluate risk; a clean record typically qualifies for lower rates, while a history of accidents or traffic violations can lead to higher premiums. Maintaining safe driving habits and avoiding infractions can help keep premiums in check and potentially earn you discounts in the long run.

In conclusion, shopping for car insurance doesn’t have to be taxing if you approach it methodically. By being informed, comparing different policies, and understanding what to look for, you’ll be well-equipped to make a decision that meets your needs and budget. Ultimately, the right car insurance will provide peace of mind on the roads and support you in the event of an unfortunate situation.