Homeowner Insurance Get To Know About Homeowner Insurance Agent Apply And Claim

Homeowner Insurance represents a fundamental aspect of property ownership, providing protection for one of the most significant investments individuals make in their lives: their homes. Understanding the various facets of homeowner insurance is crucial not only for safeguarding physical and financial assets but also for ensuring peace of mind against unforeseen events. Below is an in-depth exploration of homeowner insurance, its importance, coverage options, and factors influencing insurance premiums and claims processes.

What is Homeowner Insurance?

Homeowner insurance, also known as home insurance, is a type of property insurance that covers losses and damages to an individual’s residence, along with assets in the home. It also provides liability coverage against accidents that may occur on the property. This insurance serves as a safety net, allowing homeowners to mitigate the financial risks associated with owning a home.

The Importance of Homeowner Insurance

Homeowner insurance is critical for several reasons:

- Protects Financial Investment: One of the key reasons for having homeowner insurance is that it provides coverage for the financial investment made in purchasing a property. In case of disasters like fires, floods, or theft, homeowners can recover part of the loss through insurance claims.

- Liability Protection: Homeowner insurance often includes liability coverage, which protects the homeowner from potential lawsuits if someone is injured on their property.

- Mortgage Requirement: Lenders typically require homeowners to have insurance as a part of the mortgage agreement to protect their investment.

- Peace of Mind: Knowing that one has insurance coverage helps alleviate stress related to property ownership, allowing homeowners to focus on enjoying their homes.

Types of Coverage

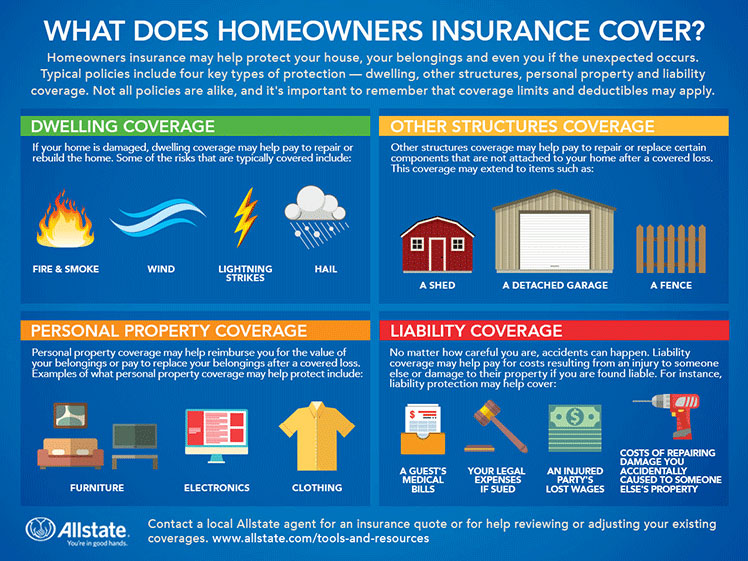

Homeowner insurance policies may differ in coverage types, often based on the specific needs and circumstances of homeowners. Here are the most common types of coverage included in homeowner insurance policies:

- Dwelling Coverage: This covers the structure of the home itself, including walls, roof, flooring, and built-in appliances.

- Personal Property Coverage: This provides coverage for personal items within the home, such as furniture, electronics, and clothing.

- Liability Coverage: This covers legal costs that arise from injuries or damages incurred by visitors to the property.

- Additional Living Expenses: If the home is uninhabitable due to a covered event, this coverage helps pay for living expenses incurred during the restoration process.

- Medical Payments Coverage: This helps cover medical expenses for guests who are injured on the property, regardless of fault.

Factors Influencing Insurance Premiums

The cost of homeowner insurance premiums can vary significantly based on several factors, including:

- Location: Homes located in areas prone to disasters such as floods or earthquakes may have higher premiums.

- Home Value: The more valuable the home, the higher the premium, as the potential payout in the event of a loss increases.

- Deductible Amount: The policyholder can often choose a deductible amount; higher deductibles generally lead to lower premiums, whereas lower deductibles raise the cost of the policy.

- Home Security Features: Homes equipped with security systems and smoke detectors may qualify for discounts on premiums.

- Claim History: Homeowners with a history of frequent claims may face higher premiums as insurers see them as higher risk.

The Claims Process

Understanding the claims process is crucial for homeowners in case they need to file a claim. Here’s an overview of the typical steps involved:

- Report the Incident: Homeowners should report any incidents to their insurance company as soon as possible.

- Documentation: It is essential to document the damage thoroughly with photographs and detailed descriptions.

- Claim Submission: Homeowners must fill out and submit a claim form, providing all necessary documentation to support the claim.

- Claim Investigation: The insurance company will investigate the claim to determine its validity and the extent of the damages.

- Payout: If the claim is approved, the insurer will issue a payment based on the policy limits and the specifics of the loss.

To fully understand homeowner insurance, it's beneficial to consider critical questions that clarify its nature and benefits. The following questions provide deeper insights into homeowner insurance.

What factors should homeowners consider when selecting a homeowner insurance policy?

Homeowners should consider coverage limits, premiums, deductibles, and the specific risks associated with their property when selecting a homeowner insurance policy. Additionally, evaluating the insurer's customer service reputation, claim handling process, and policy exclusions can greatly influence their satisfaction and protection.

How can homeowners reduce their homeowner insurance premiums?

Homeowners can reduce their homeowner insurance premiums by increasing their deductibles, improving home security features, and bundling their policies with other insurance types such as auto insurance. Additionally, maintaining a good credit score and shopping around for the best rates can also lead to lower premiums.

What types of disasters are typically covered under homeowner insurance policies?

Homeowner insurance policies typically cover disasters such as fire, lightning strikes, hail, windstorms, theft, and vandalism. However, it's important to note that specific natural disasters like earthquakes and floods may require additional policies or endorsements, as they are usually not included in standard homeowner insurance coverage.