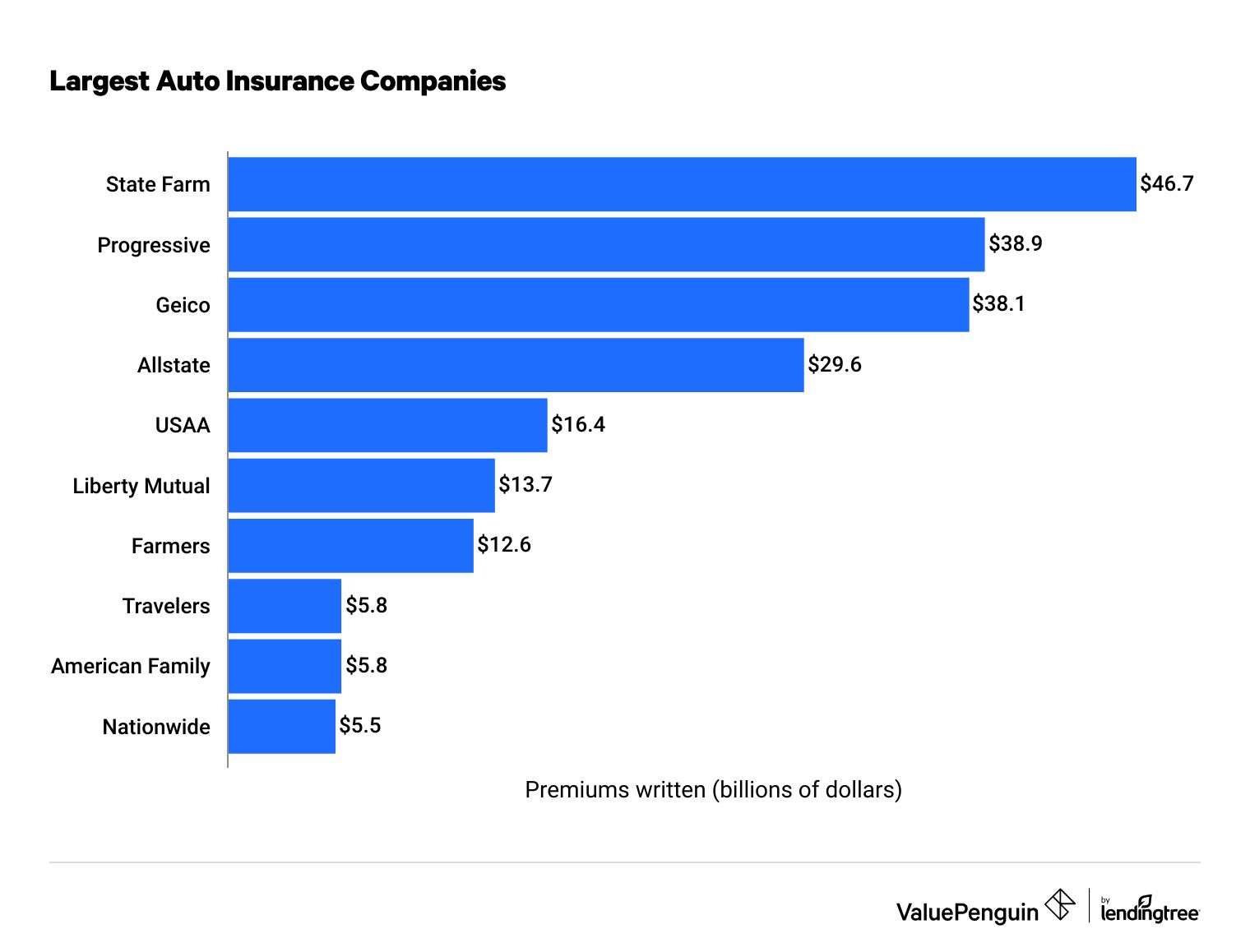

Insurance For Auto List Of Best Car Insurance Company List 2022

Insurance for auto is an essential consideration for vehicle owners, serving as a financial safety net against unexpected events such as accidents, theft, or damages. With the increasing cost of vehicles and the potential liability associated with road usage, understanding auto insurance fundamentals becomes critical. Various types of coverage options exist, tailored to meet different needs and circumstances, making it a subject worth exploring in detail.

Comprehensive Coverage

Comprehensive coverage protects against non-collision-related incidents. This could include damage due to theft, vandalism, natural disasters, or even hitting an animal. Key points include:

- Protects against a wide range of risks.

- Covers damages not involving a collision.

- May be required by lenders for financed vehicles.

Liability Coverage

Liability coverage is mandatory in most states and covers injuries and damages caused to others if you are at fault in an accident. Critical aspects of liability coverage include:

- Two main types: bodily injury and property damage.

- Protects your assets in case of a major accident.

- The minimum coverage limits vary by state.

Collision Coverage

Collision coverage pays for damages to your car after a collision with another vehicle or object, regardless of fault. It has key features such as:

- Helps repair or replace your vehicle after an accident.

- Determines payout based on your car's value.

- Strongly recommended for newer or higher-value vehicles.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who does not have insurance or lacks sufficient coverage. Highlights include:

- Protects against accidents involving uninsured drivers.

- Helps cover medical expenses and vehicle repairs.

- Can be crucial in areas with higher rates of uninsured motorists.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, pays for medical expenses incurred by you and your passengers after an accident, regardless of fault. Its key attributes include:

- Covers medical costs with no deductible.

- Applicable for a wide scope of medical services.

- Can cover expenses beyond just immediate medical treatment.

Finding Discounts

Auto insurance providers often offer various discounts for factors such as safe driving records, multiple policies, and good grades for students. It's crucial to inquire about potential discounts to lower overall insurance costs. Some common discounts include:

- Safe driver discounts for accident-free records.

- Bundling discounts for multiple policies.

- Student discounts for young drivers with good grades.

Understanding the various types of auto insurance coverage allows vehicle owners to select plans that best fit their unique needs, ensuring protection against potential financial burdens associated with auto-related incidents.

1. Why is it important to understand the different types of auto insurance coverage?

Understanding the different types of auto insurance coverage is crucial for vehicle owners as it informs them about their options for financial protection against various risks associated with driving. This knowledge helps individuals select appropriate coverage that matches their needs and circumstances while ensuring compliance with legal requirements.

2. What factors should be considered when choosing auto insurance coverage?

Factors to consider when choosing auto insurance coverage include state-specific legal requirements for minimal coverage, individual financial situation, the value of the vehicle, driving history, and specific risks associated with the driver and location, which can significantly influence the choice of coverage and premiums.

3. How can vehicle owners lower their auto insurance premiums?

Vehicle owners can lower their auto insurance premiums by taking advantage of discounts offered by insurers, improving their driving records, opting for higher deductibles, maintaining a good credit score, and comparing quotes from different providers to find the most competitive rates.