Insurance Quote 20 Free Life Insurance Quote Pictures & Photos 2018

Insurance quotes serve as an essential aspect of the insurance purchasing process. They provide prospective policyholders with cost estimates based on various factors, aiding decision-making when it comes to buying insurance. An insurance quote is not just a figure, but a reflection of personal circumstances, coverage levels, risk assessment, and many other influencing elements.

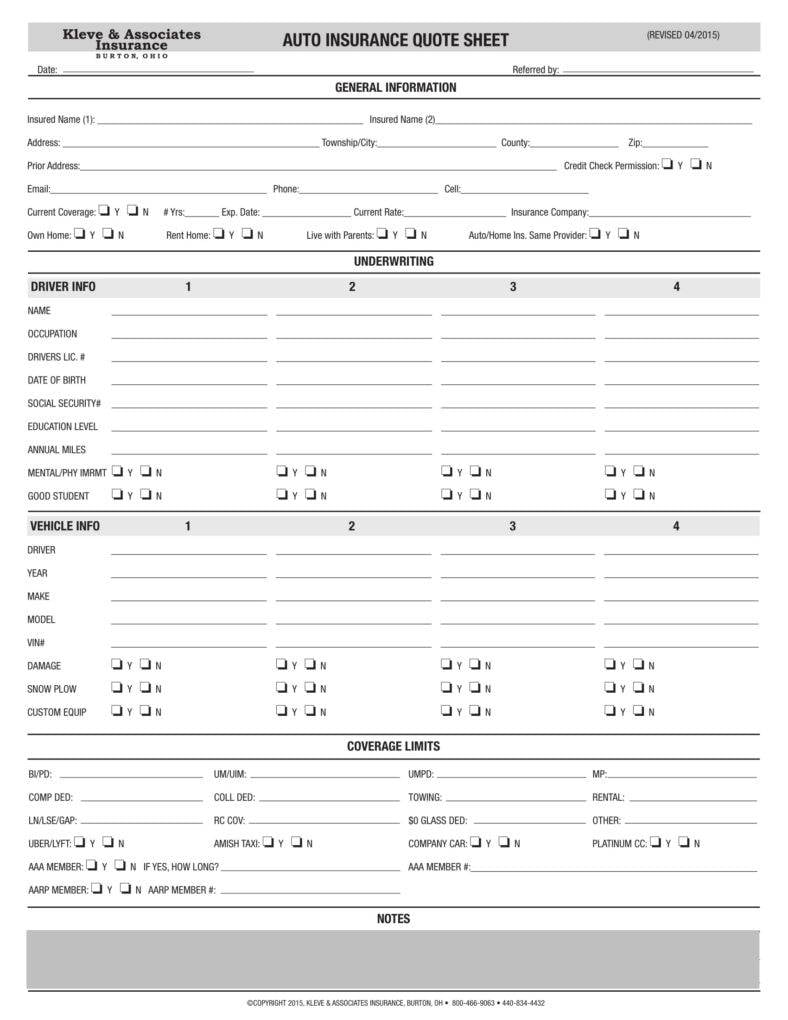

The process of obtaining an insurance quote can vary depending on the type of insurance—be it auto, life, health, or commercial insurance. It generally involves providing personal information and answering specific questions to allow insurers to assess risk accurately and assign a premium. Below, we delve into various components of insurance quotes, including their significance, how to obtain them, and factors that influence the pricing. Further, we will explore questions related to this topic to deepen understanding.

Understanding Insurance Quotes

Insurance quotes are primarily designed to provide an estimated cost for insurance coverage. Each quote is tailored based on individual circumstances, and the following aspects typically influence the final cost:

- Type of Insurance: The category of insurance you seek significantly affects the premium. Life insurance, for example, usually has different rates compared to auto or commercial insurance.

- Coverage Level: The amount of coverage desired plays a crucial role in determining the quote. Higher coverage level invariably results in a higher premium.

- Personal Information: Insurers often require details such as age, health status, driving record, and occupation to assess risk levels.

- Deductibles: Opting for a higher deductible can reduce the premium cost, but may increase out-of-pocket expenses in the event of a claim.

- Insurance Provider: Different insurers have varied models for calculating premiums. Shopping around can provide a range of quotes for similar coverage.

- Discounts: Insurers often offer discounts based on various criteria such as bundling coverage, safe driving, and maintaining good credit history.

Steps to Obtain an Insurance Quote

Acquiring an insurance quote can be streamlined through a series of steps:

- Research: Begin by researching the type of insurance you need and the various policies available.

- Online Tools: Utilize online quote comparison tools or individual insurance company websites to obtain preliminary quotes.

- Provide Accurate Information: Fill out necessary forms, being precise with information to ensure accurate quotes. Misleading information can lead to issues later on.

- Review Quotes: After receiving different quotes, take time to compare them based on coverage, premiums, and terms.

- Contact Agents: Consider contacting insurance agents for a more personalized quote and to clarify any uncertainties.

Factors Influencing Insurance Quotes

The cost of insurance quotes can be influenced by several factors, including the following:

- Health Condition: For life insurance quotes, personal health conditions can lead to different rates depending on statistics related to mortality and morbidity.

- Location: Where you reside can affect auto and home insurance quotes due to regional risk factors such as theft rates, natural disasters, and local regulations.

- Claim History: A history of claims can present your profile as riskier to insurers, resulting in higher premiums.

- Credit Score: A good credit score can lead to lower insurance quotes, as insurers use this information to predict the likelihood of a claim.

- Experience and Age: For auto insurance, younger drivers or inexperienced individuals often receive higher quotes due to the statistically higher accident rates.

Benefits of Obtaining Multiple Insurance Quotes

There are numerous advantages to gathering diverse insurance quotes:

- Competitive Pricing: Comparing quotes from various providers allows you to leverage competitive pricing, which can lead to substantial savings.

- Different Offerings: Each insurer may have different policy offerings, inclusions, and exclusions. Reviewing multiple quotes gives you a broader view of what's available.

- Understanding Coverage Differences: Comparing quotes helps clarify and highlight differences in coverages, which is instrumental in making an informed decision.

- Negotiation Power: Having multiple quotes can empower you to negotiate better terms or seek additional benefits from insurers.

Common Questions about Insurance Quotes

To enhance your understanding of insurance quotes, we will address some common inquiries related to the topic:

What aspects do I need to know before requesting an insurance quote?

Before requesting an insurance quote, you should be aware of your personal information, the type of coverage you require, and any specific features or riders you want. Additionally, understanding your budget and how much premium you can afford is critical. This knowledge will help you communicate effectively with insurers and ensure that you receive quotes that genuinely meet your needs.

How often should I compare insurance quotes?

It is advisable to compare insurance quotes at least once a year or whenever there is a significant change in your circumstances, such as moving to a new location, purchasing a new vehicle, or experiencing health changes. Frequent comparison will ensure that you are not overpaying for your insurance and that you are receiving the best possible quote based on current factors.

Can I get an insurance quote without sharing my personal details?

Generally, obtaining an accurate insurance quote requires sharing some personal information. However, some quote comparison tools allow for preliminary estimates based on generic data. While these estimates can give you an idea of potential costs, they may not reflect the personalized circumstances that actual insurers will consider when providing formal quotes.

Insurance quotes form the foundation of informed insurance purchasing decisions. By understanding their mechanics and gathering multiple quotes, consumers are better equipped to navigate the complexities of insurance and make choices that best suit their needs and budgets.