Inexpensive Car Insurance Cheapest Car Insurance Our Research Shows That Geico Has The Cheapest

In today's fast-paced world, owning a car has become a necessity for many people. However, one of the primary concerns for car owners is the cost of insurance. Inexpensive car insurance is not just about finding the lowest premium but understanding the various options available that can provide adequate coverage at an affordable price. This article delves into the ins and outs of inexpensive car insurance, helping you to navigate the often confusing landscape of auto insurance.

When searching for inexpensive car insurance, it’s essential to consider the following factors:

- Understand Your Needs: Before you begin shopping for insurance, evaluate your driving habits, the type of car you own, and how much coverage you actually need. This understanding will help you determine what level of coverage is necessary.

- Shop Around: Don’t settle on the first quote you receive. Shopping around and comparing multiple insurance providers can lead to significant savings. Make use of online comparison tools to get quotes from various companies quickly.

- Consider Driving Records: Your driving history plays a crucial role in determining insurance rates. If you have a clean driving record, you may qualify for discounts. Conversely, accidents or tickets can raise your premium.

- Take Advantage of Discounts: Many insurance providers offer various discounts. These can include discounts for safe driving, multi-policy bundling (combining auto with home or life insurance), military service, and good student discounts.

- Evaluate Coverage Options: While you want to keep premium costs low, ensure that you are not underinsured. Optional coverages like collision coverage and comprehensive coverage can be vital, depending on your vehicle’s value and your financial situation.

- Increase Your Deductibles: A higher deductible generally means a lower premium. However, make sure that you can comfortably pay this amount in case of an accident.

- Review the Policy Regularly: Life circumstances change. It’s wise to review your insurance policy at least once a year to ensure that you still have the best coverage for your current needs.

- Consider the Type of Vehicle: The make and model of your vehicle can drastically affect your insurance premiums. Research the insurance costs associated with the vehicles you’re interested in purchasing, as some cars are cheaper to insure than others.

Understanding the available discounts can significantly reduce your insurance costs. Insurers often provide discounts based on your driving habits, safety features in your car, and affiliations with particular organizations. Being proactive about seeking these discounts can lead to considerable savings.

When considering more expensive vehicles, such as a luxury model like the Lamborghini Aventador, you'll often find higher insurance rates. This demonstrates the relationship between vehicle type and insurance cost, where risk assessment plays a significant role.

For foreigners or new residents, understanding the local auto insurance requirements and navigating the market can be challenging. Many states have varying regulations and insurance requirements, which can impact your costs and coverage options.

New cars often come with warranties and additional features that can affect your insurance needs. It is crucial to reevaluate your insurance policy when purchasing a new vehicle. New car insurance can be more costly due to the higher value, so understanding how to adjust your coverage is vital.

Some vehicles are notoriously cheaper to insure. Researching and choosing cars with lower insurance rates can be a wise financial decision in the long run. Look for vehicles with high safety ratings and low theft rates, as these often qualify for lower premiums.

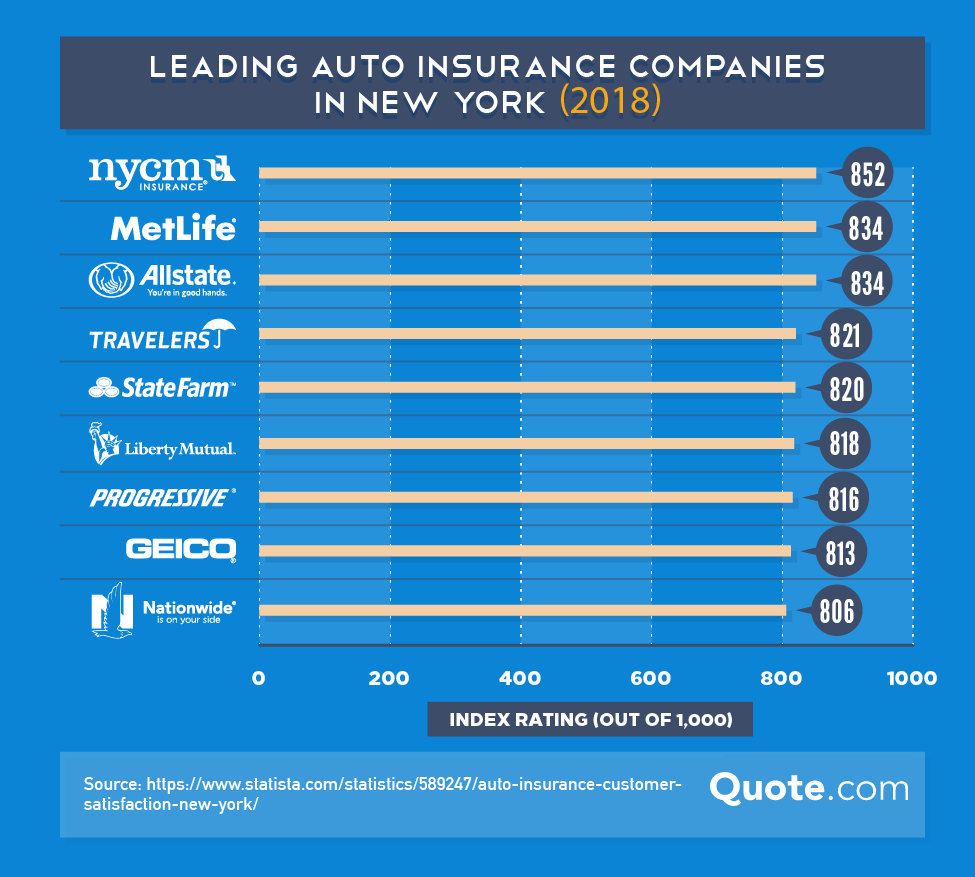

Finding the right auto insurance company requires diligence and research. The best company for one individual may not be the best for another. Factors such as customer service quality, claims handling, and financial stability should all be considered.

In conclusion, finding inexpensive car insurance requires careful consideration, research, and a bit of time. By understanding your needs, taking advantage of discounts, and shopping around, you can find a policy that fits your budget and provides excellent coverage.

1. What factors should I consider to find inexpensive car insurance?

When seeking inexpensive car insurance, you should consider factors such as your driving record, the type of car you drive, available discounts from insurance providers, coverage needs, and your financial situation. Thoughtfully evaluating these attributes can significantly influence your insurance premium.

2. How do insurance companies determine car insurance rates?

Insurance companies determine rates based on a variety of criteria including the driver's age, gender, driving record, credit score, the car's make and model, and the geographic location of the insured. These factors help insurers assess the risk associated with providing coverage, which directly impacts the premium amount.

3. What steps can I take to lower my car insurance premium?

To lower your car insurance premium, you can increase your deductibles, bundle multiple policies for discounts, maintain a clean driving record, utilize available discounts, and review your insurance coverage regularly. Each of these strategies can lead to significant savings on your insurance policy.